2.1

What is an investment portfolio, and what does is consist of?

An investment account or portfolio is a collection of financial assets, such as stocks, bonds, mutual funds, and other securities, that are held by an investor. The purpose of an investment account or portfolio is to generate returns for the investor through the appreciation of the assets it holds or through income generated by the assets, such as dividends or interest payments.

The specific assets that make up an investment account or portfolio will depend on the investor's financial goals, risk tolerance, and investment horizon, as well as the specific investments that are available. An investment account or portfolio may consist of a variety of different asset classes, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs), among others.

Investors may choose to manage their investment account or portfolio themselves or work with a financial advisor or wealth manager to develop and manage the portfolio on their behalf. It is important for investors to regularly review and assess their investment account or portfolio to ensure that it is aligned with their financial goals and risk tolerance and to make any necessary adjustments.

2.2

What is consolidated portfolio reporting?

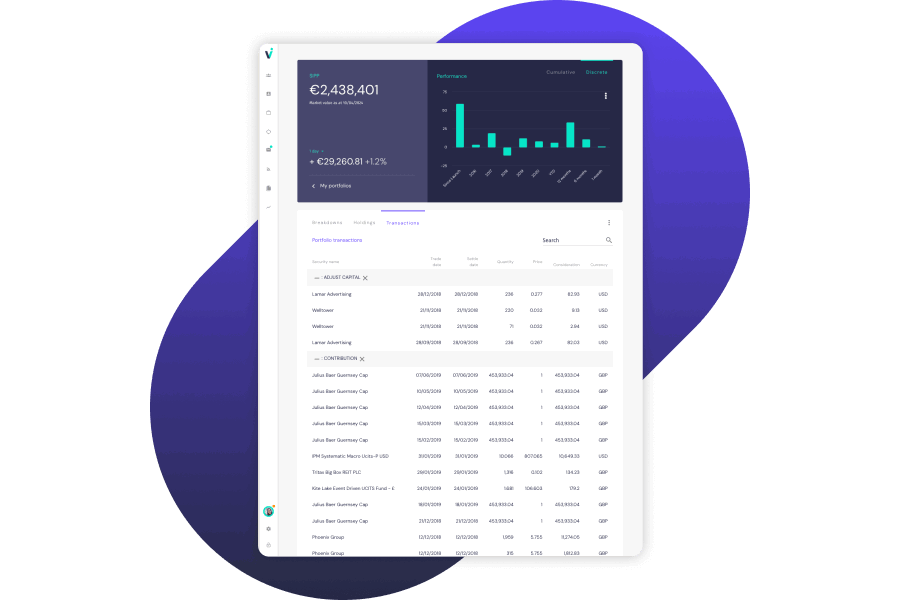

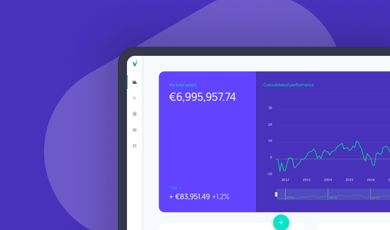

Consolidated portfolio reporting is the process of aggregating information about the holdings and performance of multiple investment accounts or portfolios into a single, comprehensive report. This can be useful for investors who hold investments in multiple accounts or with multiple investment advisors, as it provides a comprehensive view of the investor's overall portfolio.

Consolidated portfolio reporting may include information about the portfolio's asset allocation, performance, risk profile, and individual holdings. It may also include data on fees and expenses, cash balances, and other financial metrics.

Consolidated portfolio reporting can be helpful for investors who want to better understand their overall investment strategy and the performance of their portfolio. It can also be useful for tracking the progress of an investment portfolio over time and making any necessary adjustments to meet the investor's financial goals.

2.3

What is a portfolio valuation?

Portfolio valuation is the process of determining the current value of a portfolio of investments. This is typically done by calculating the market value of each individual investment in the portfolio and then adding those values together to arrive at the total portfolio value.

There are a few different methods that can be used to value a portfolio, depending on the types of investments held in the portfolio and the information that is available. Some common methods include:

Market value

This method involves determining the current market price of each investment in the portfolio and adding those values together to determine the portfolio value.

Cost basis

This method involves calculating the value of the portfolio based on the original purchase price of the investments, adjusted for any dividends or other income received.

Net asset value

This method is commonly used for valuing mutual funds and other types of investment funds. It involves calculating the value of the portfolio by dividing the total value of the assets held in the fund by the number of shares outstanding.

2.4

What are the different types of investment portfolios?

There are many different types of investment portfolios that can be created, depending on an individual's financial goals, risk tolerance, and other factors. Here are a few common types of investment portfolios:

Growth portfolio

A growth portfolio is designed to achieve long-term capital appreciation, often by investing in stocks of companies with strong potential for growth. These portfolios tend to be more aggressive and may have higher levels of risk.

Income portfolio

An income portfolio is designed to generate regular income from dividends, interest, or other sources. These portfolios may include investments such as bonds, real estate, or dividend-paying stocks.

Balanced portfolio

A balanced portfolio is designed to achieve a balance between growth and income, often by combining stocks, bonds, and other investments in a single portfolio. These portfolios may be suitable for investors who are looking for both capital appreciation and a steady stream of income.

Defensive portfolio

A defensive portfolio is designed to protect against market volatility and economic downturns, often by investing in more stable assets such as cash, bonds, and defensive stocks. These portfolios tend to be more conservative and may have lower levels of risk.

Custom portfolio

Some investors may choose to create a custom portfolio that is tailored to their specific financial goals and risk tolerance. This may involve selecting individual investments or using a combination of different types of investment vehicles.