1.1

What are investment reports, and why do they matter?

Investment reporting is the process of providing information to you, the investor, about the performance and holdings of your investment portfolio.

Investment reports typically include a range of financial data and metrics, such as the portfolio's return, risk profile, asset allocation, and individual holdings.

Understanding your investment portfolio is an important aspect of managing your financial affairs and working towards your long-term financial goals. Key reasons include:

Diversification

By understanding your portfolio, you can ensure that you have a diverse range of investments, which can help to spread risk and potentially improve the overall performance of your portfolio.

Risk management

Knowing what's in your portfolio can help you to assess the level of risk you are taking on and whether or not it is appropriate for your goals and risk tolerance.

Goal-setting

Understanding your portfolio can help you to set specific financial goals and track your progress towards achieving them.

Tax planning

Some investments may have tax implications that you need to consider as part of your overall financial plan. By understanding your portfolio, you can make informed decisions about when to sell certain investments and when to hold onto them.

Monitoring performance

By regularly reviewing your portfolio, you can track its performance and make any necessary adjustments to keep it aligned with your financial goals.

1.2

What are the key elements of investment reporting?

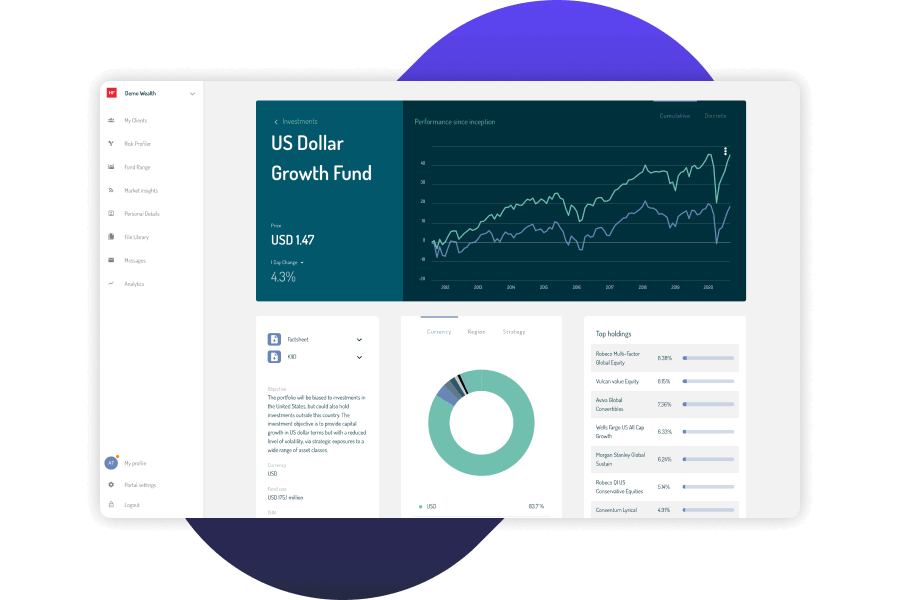

Investment reporting is an important tool for helping you understand the performance and composition of your portfolio and make informed decisions about your investments. Several key elements are typically included in investment reporting:

Holdings

A list of the specific investments that are held in the portfolio, including the type of investment, the quantity, and the current value.

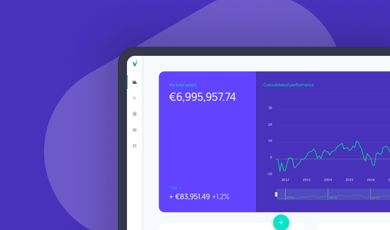

Performance

This may include information on the return on investment (ROI) for each individual investment as well as the overall portfolio.

Asset allocation

This refers to the mix of different types of investments in the portfolio, such as stocks, bonds, and cash.

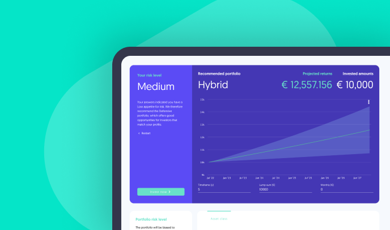

Risk profile

This may include information on the level of risk associated with the portfolio, as well as the level of risk tolerance of the investor.

Fees and expenses

Investment reporting should also include information on any fees or expenses associated with the portfolio, such as management fees or trading costs.

Tax considerations

Investment reporting may include information on the tax implications of the portfolio, including any tax-loss harvesting opportunities or tax-efficient strategies that have been implemented.

1.3

How do Asset and Wealth Managers typically provide reports?

Wealth managers typically provide investment reports to their clients on a regular basis, such as quarterly or annually. These reports may be provided in electronic formats, such as through a secure online portal or by email, or they may be provided in paper form.

The specific format and content of the reports may vary depending on the wealth manager and the preferences of the client. In general, however, investment reports should provide information on the investments held in the portfolio, the performance of those investments, and any other relevant details.

Wealth managers may also provide additional reports or analysis on specific topics, such as market trends or the economic environment, to help clients stay informed about their investments and the broader financial markets.

In addition to investment reports, wealth managers may also provide other types of support and services to their clients, such as financial planning, tax planning, and risk management. The specific services offered may vary depending on the wealth manager and the needs of the client.

1.4

What are common terms in investment reporting?

Investment reporting includes a lot of technical terms, which can be daunting. Understanding the most common of these can be helpful when reviewing investment reports and making informed decisions about their portfolio. The most common terms found in investment reporting include:

Asset allocation refers to the mix of different asset classes in a portfolio, such as stocks, bonds, and cash.

Risk is the potential for loss or the uncertainty of achieving a desired outcome. Investment risk may be evaluated in terms of the potential for loss of capital, volatility, or other measures.

Return is the income or profit generated by an investment over a given period of time. It may be expressed as a percentage or monetary amount.

Diversification refers to the practice of holding a variety of different investments in a portfolio in order to spread risk and potentially increase the portfolio's return.

Rebalancing is the process of adjusting the asset allocation of a portfolio to align with the investor's financial goals and risk tolerance.

Performance refers to the financial results or return of an investment or portfolio over a given period of time.

Volatility is a measure of the fluctuations in the price or value of an investment over time. Higher volatility may indicate higher risk.

Liquidity refers to the ease with which an investment can be bought or sold. Highly liquid investments can be traded quickly and with minimal impact on the investment's price.