3.1

What is investment performance?

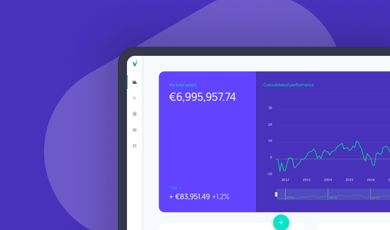

Investment performance refers to the return on investment (ROI) that an investor has achieved over a given period of time. ROI is a measure of the profitability of an investment, calculated by dividing the gain or loss on the investment by the original cost of the investment. Investment performance can be measured in a variety of ways, including:

Absolute return

This refers to the overall gain or loss on an investment, expressed as a monetary amount or percentage.

Annualised return

This measures the average annual return on an investment over a given period of time, such as a year or several years.

Risk-adjusted return

This measures the return on an investment after taking into account the level of risk associated with the investment. This can be helpful for comparing the performance of investments with different levels of risk.

Benchmark return

Some investors may compare the performance of their investments to a benchmark, such as a stock market index, to see how their investments are performing relative to the market.

3.2

What is cumulative versus discrete performance?

Cumulative performance and discrete performance are two different ways of measuring the return on an investment over a given period of time.

Cumulative performance measures the total return on an investment over a given period of time, including both the appreciation in the value of the investment and any income or dividends that have been received. This is often expressed as a percentage or dollar amount.

Discrete performance, on the other hand, measures the return on an investment over a specific time period, such as a month or a year. This may include the appreciation in the value of the investment as well as any income or dividends received during that specific time period.

Both cumulative performance and discrete performance can be useful for evaluating the performance of an investment. Cumulative performance can provide a long-term perspective on the performance of an investment, while discrete performance can help to identify short-term trends or changes in the performance of an investment.

3.3

How do we typically breakdown investment portfolio holdings?

There are a number of ways to breakdown the holdings in an investment portfolio. Here are a few common methods:

Asset allocation

This refers to the mix of different types of investments in the portfolio, such as stocks, bonds, cash, and other assets. An investor's asset allocation may vary depending on their financial goals, risk tolerance, and other factors.

Geographical diversification

This refers to the distribution of investments across different regions or countries. This can help to spread risk and potentially improve the overall performance of the portfolio.

Sector diversification

This refers to the distribution of investments across different sectors of the economy, such as technology, healthcare, finance, and so on. This can help to reduce the impact of any specific sector-specific risks on the portfolio.

Investment style

Some investors may also breakdown their portfolio holdings by investment style, such as value, growth, or income. This can help to better understand the underlying characteristics of the portfolio and how it is likely to perform in different market environments.

3.4

What are the main elements of a Holding's valuation?

There are several key elements that are typically considered when valuing a holding, or an individual investment, in a portfolio. These may include:

Market price

The market price is the current price at which an investment is being traded in the market. This is generally the most obvious and straightforward way to value an investment.

Earnings

Earnings, such as dividends or interest, can be a key driver of the value of an investment. The potential for future earnings may be considered when valuing an investment.

Book value

The book value of an investment is the value of the investment as recorded on the company's balance sheet. This may be different from the market price, especially for assets such as real estate or intangible assets that are difficult to value.

Future growth potential

The future growth potential of an investment may also be considered when valuing an investment. This may include factors such as the company's financial performance, competitive advantage, and industry trends.

Risk

The level of risk associated with an investment may also be taken into account when valuing an investment. Higher levels of risk may be reflected in a lower valuation, while lower levels of risk may be reflected in a higher valuation.

3.5

What are the main elements in a portfolio's transaction statement?

A portfolio transaction statement is a document that outlines all of the transactions that have taken place within a portfolio over a given period of time. Here are some of the key elements that may be included in a portfolio transaction statement:

Investment details

The transaction statement may include information on the specific investments that have been bought or sold, such as the ticker symbol, the number of shares or units, and the price per share or unit.

Dates

The transaction statement may include the date of each transaction, which can be useful for tracking the performance of the portfolio over time.

Transaction type

The transaction statement may also include information on the type of transaction that took place, such as a purchase, sale, dividend, or distribution.

Fees and expenses

The transaction statement may include any fees or expenses that were incurred as a result of the transaction, such as brokerage fees or taxes.

Net changes

The transaction statement may also include information on the net change in the value of the portfolio as a result of the transactions, including any gains or losses.

3.6

What are the main fees and charges levied by asset and wealth managers?

There are a number of fees and charges that may be levied by a wealth manager. These may include:

Management fees

Wealth managers may charge a fee for managing a portfolio, which may be based on a percentage of the assets under management. This fee is usually charged on an ongoing basis and may be deducted from the portfolio on a regular basis.

Trading costs

Wealth managers may also charge fees for executing trades on behalf of their clients. These may include brokerage fees, commission charges, and other related costs.

Platform and custodial fees

Some wealth managers may charge a fee for holding and safeguarding the assets in a portfolio. This may be charged on an ongoing basis or as a one-time fee.

Performance fees

Some wealth managers may charge a performance fee based on the performance of the portfolio. This fee may be charged as a percentage of the investment returns achieved above a certain benchmark.

Other fees

There may be other fees and charges levied by a wealth manager, such as fees for financial planning or tax preparation services.

It is important for investors to carefully review the fees and charges associated with their wealth management services and to understand how these fees may impact the overall performance of their portfolio. It is also a good idea to compare fees and charges from different wealth managers to ensure that you are getting good value for your money.