In our interview with the Wealth Mosaic, we describe the Invessed platform and its capabilities

I recently recorded a video with Stephen Wall from Wealth Mosaic. In preparation, I put together some notes that didn't quite make it whilst I was (literally) on the spotlight. Here they are, for posterity and your reading pleasure.

Having touched on the purpose and history of Invessed as a company, the discussion turned on the Platform itself, before we address the industry challenges in Part 3.

1. Can you give us an overview of the Solution offering?

Invessed is a “platform”, in other words, a toolkit for creating digital products. Our clients – typically Wealth or Asset managers – use this toolkit to accelerate the development of their digital offerings for their investors using components for web, mobile, analytics, security, and Cloud.

Invessed is a “platform”, in other words, a toolkit for creating digital products without reinventing the wheel.

The first aspect of the solution, Invessed Experience, is used to create lead-generation websites, investor portals, and mobile apps; it’s about data distribution, compliance, and basic customer experience.

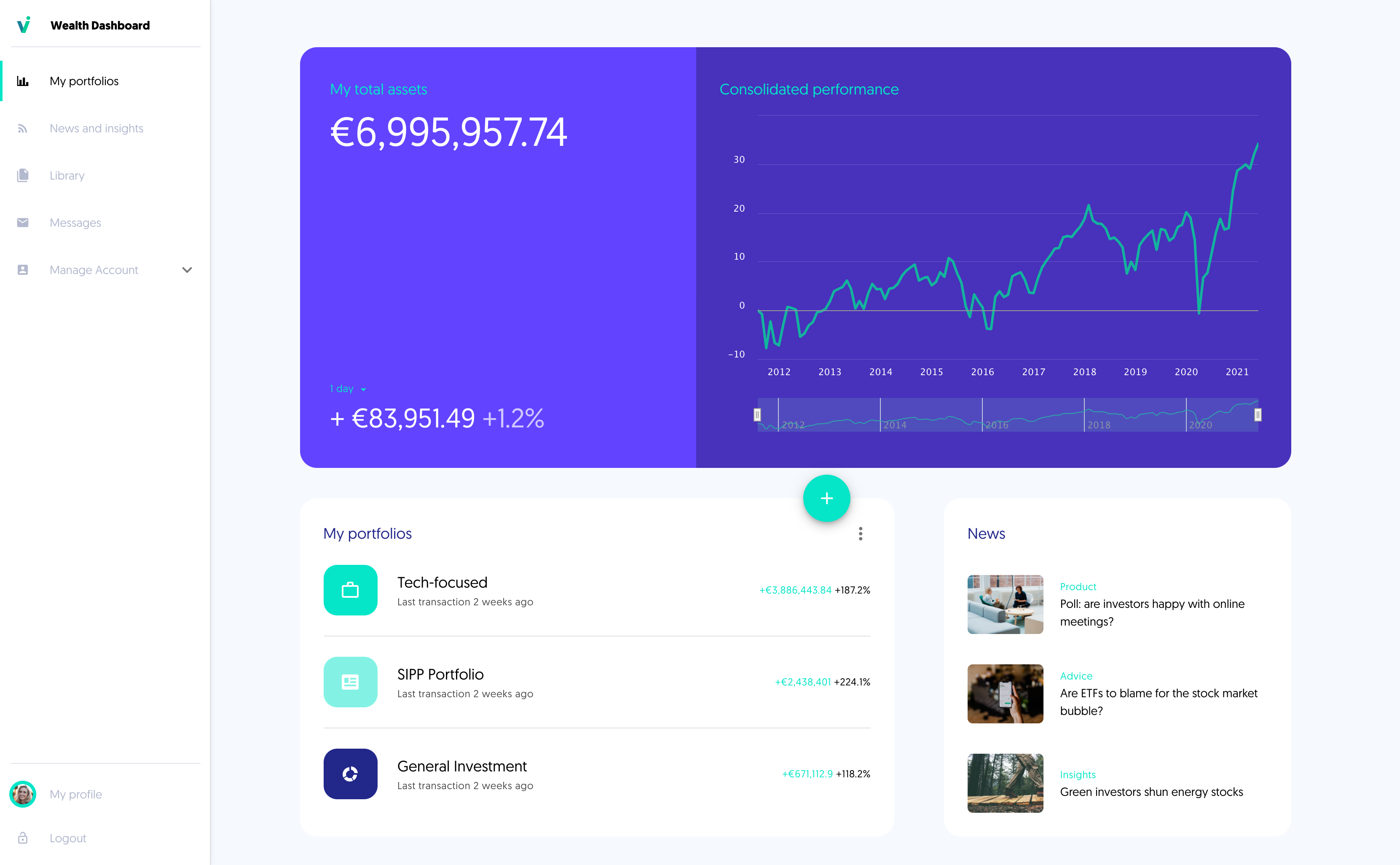

The second aspect, Invessed Analytics is used to track investor behavior, collect data and visualize it on a web Dashboard; this is about evolution through data and actionable insights.

The third aspect, Invessed Cloud, is the technology core that powers Experience and Analytics, but can be used standalone for integrations, data management, and security; it is about efficiency and IT modernization.

2. What is the key principle that drives the platform?

Earlier on I explained that our USP is client-centricity: we designed the technology so that it adapts to the needs of the investor and the business, not the other way around. So the key virtue in our architecture is flexibility – in the front-end (what it looks and feels like) but also in the back (we can integrate with anything).

Armed with this flexibility, we are free to explore a customer-centric approach, without biasing towards the capabilities of the platform, a constraint that leads many firms to solve the wrong problem.

3. Can you share uses cases and outcomes Wealth Managers can expect?

The most common use cases are investor portals such as the ones we have built for London & Capital and Prosperity Capital. Typically integrated with a CRM like Dynamics, or a portfolio system like Advent, Invessed provides secure, instant window into an investment account. Typical tools include interactive reports, document and media libraries, file repositories and secure messaging.

Another use case are public websites for lead-generation or fund publishing purposes – and we have developed such sites for clients like Ethenea and Rivertree Funds. These are also integrated with CRMs for lead tracking and we usually draw market data from providers like Anevis. Compliance is key here, so we have developed tools to ensure the right people can see the right information – across different jurisdictions.

A third use case that we deploy in both instances is our Analytics tools, where we track investor behavior across channels and then visualize it in a Dashboard. This is a step above anonymized tools like Google Analytics, which have limited value as they cannot drive true personalization or help with general account management.

4. What is the development focus going forward?

Flexibility aside, there is one element where all stakeholders converge – clients, marketing, IT, regulators – and that is security. Protecting the integrity and controlling access to investor data is on its way to becoming the most severe threat that investment brands are facing.

With that in mind, our development focus is firmly on security. From top to bottom, security weighs heavily in all decision-making. We use the Cloud because vendors respond faster to global threats than IT departments. We rely on Azure because Microsoft spends an unmatched $1B annually on security.

And we use common sense. From DDoS to XSS and 2FA security is packed with technical acronyms, yet the weakest link is always the human. We see usability as part of security – not a hindrance – which links nicely with our client-centric approach.