Wealth and asset managers must articulate their fees clearly - while investing in delivering an exceptional client experience.

Key points

- Wealth and asset managers have always been reticent about fees, attracting regulation and drawing attention from customer champions

- Investment fees are complex and the value of investing is not immediately obvious to clients

- Wealth and asset managers must take the trouble to articulate fees, within a great customer experience

- An elegant Client Portal is the ideal solution for doing both

The elephant in the room

While some wealth and asset managers have traditionally been coy about their fees, investors also often neglect to ask what they’re being charged - which can result in an unpleasant surprise further down the line. Investment fees are generally not visible enough. Sometimes there may be fees which the firm neglects to mention, that are additional to its annual management fees. For example, a fund that a firm puts investors’ money into may carry an internal management fee. Today, both regulatory measures and efforts to educate the market are encouraging greater transparency on fees.

Asking someone to pay for potential future prosperity is a hard sell

In The Psychology of Money, Morgan Housel writes “The question is: Why do so many people who are willing to pay the price of cars, houses, food, and vacations try so hard to avoid paying the price of good investment returns? The answer is simple: The price of investing success is not immediately obvious.” Unlike jewellery, art or a luxury vehicle, investing in funds may not deliver rewards for decades. Paying fees years in advance feels like a “grudge purchase” for investors.

Many wealth and asset managers regularly remind investors of the future prosperity they are investing in, while making an effort to explain the dynamics of different kinds of fees relative to returns. Yet even they may have trouble de-complexifying fees without a compelling, visual way to illustrate them.

Investors appreciate a great experience as much as investment returns

Today, customers in all spheres, including the financial sector, pursue multichannel access to the service providers of their choice and are accustomed to “always-on” personalised, intuitive service at their fingertips. As a result, nine out of ten organisations expect to be competing primarily on customer experience within the next five years. If your firm can find an affordable and effective way to both articulate your fees and deliver a great experience, the retention and acquisition of investors should be strengthened.

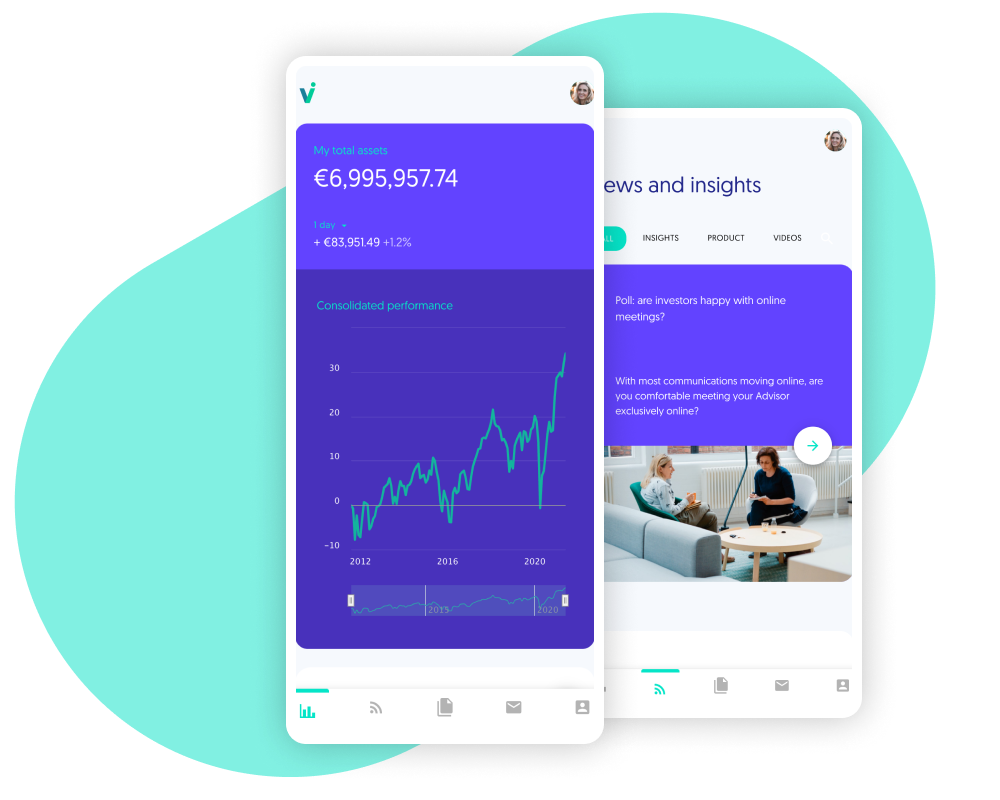

Delivering transparency and excellent service with a Client Portal

A Client Portal is an all-in-one digital platform for financial firms. Clients can log in securely, make requests, give feedback, read updates and study interactive fund factsheets at their leisure. It moves engagement and reporting beyond e-mail and PDFs and ensures a premium experience for investors - 24/7, on any device.

- Because it graphically illustrates long-term portfolio or fund performance, whether historically or projection-based, a Client Portal gives investors a constant visual reminder of why they’re investing and why it’s worth the fees.

- Because a Client Portal can present any financial data in an engaging interactive manner, it can be used to articulate fees with clarity.

If you’re a wealth or asset manager, click here to book a 30-minute demo, so that we can show rather than tell you more.