Our survey of younger investors (Generation X, Millennials, and Generation Z) revealed a concerning trend of discomfort and disengagement with wealth management practices. This analysis explores the findings and their implications for the financial services industry:

Financial literacy gap: A substantial 42% of respondents express discomfort with fundamental investing principles, indicating a significant knowledge deficit in this demographic. This lack of understanding extends to basic concepts such as:

- Portfolio diversification and its importance in risk management

- The relationship between risk and return in different investment vehicles

- The impact of fees and expenses on long-term investment performance

- The role of asset allocation in achieving financial goals

This knowledge gap affects individual financial decision-making and contributes to younger generations' reluctance to engage with professional wealth management services. The survey indicates that 56% of younger investors are unlikely to seek professional advice in the next five years, partly due to their lack of financial literacy and discomfort with wealth management concepts.

Inadequate savings and investment habits: The survey reveals a concerning trend among younger investors:

- Nearly half (47%) are not allocating sufficient portions of their income towards savings or investments.

- This inadequate saving behaviour potentially jeopardises their long-term financial security.

- Factors contributing to this trend may include:

- Rising living costs, particularly in urban areas where many young professionals reside

- Student loan debt, which often takes priority over savings for many in this demographic

- Lack of financial education, as indicated by the 42% who are uncomfortable with basic investing principles

- Short-term financial focus, possibly due to economic uncertainties or changing job markets

- This trend aligns with the finding that 51% feel they have little or no control over their finances, suggesting a need for targeted financial education and support from wealth management firms.

Lack of portfolio engagement: An alarming 61% of respondents admit to infrequent monitoring of their investment portfolios, suggesting a significant disconnect between these investors and their financial futures. This lack of engagement is particularly concerning for several reasons:

- Missed Opportunities: Infrequent monitoring can lead to missed opportunities for rebalancing or taking advantage of market changes.

- Risk Management: Without regular oversight, investors may not be aware of how market fluctuations are affecting their risk exposure.

- Long-term Goal Alignment: Lack of engagement makes it difficult to ensure investments align with changing financial goals and life circumstances.

- Financial Literacy: This disengagement may stem from or contribute to the 42% uncomfortable with basic investing principles, creating a cycle of financial illiteracy.

To address this issue, wealth managers should focus on creating user-friendly digital tools that make portfolio monitoring and investment reporting more accessible and engaging while providing educational resources to help younger investors understand the importance of regular financial check-ins.

Perceived lack of financial control: The survey reveals a critical issue among younger investors:

- 51% report feeling minimal or no control over their financial situations

- This lack of perceived control correlates with other findings:

- 42% are uncomfortable with basic investing principles

- 47% save or invest too little of their income

- 61% don't regularly monitor their portfolio

- These interconnected issues highlight a significant opportunity for wealth managers to:

- Provide educational resources to improve financial literacy

- Offer tools and guidance to help establish better saving and investing habits

- Develop engaging platforms that encourage regular portfolio monitoring

By addressing these areas, wealth managers can help younger investors gain greater control over their finances, potentially leading to increased engagement and trust in wealth management services.

These findings highlight an urgent need for wealth management firms to reassess and modernise their approaches to serve and engage this demographic effectively. The financial services industry faces a critical challenge: bridging this engagement gap to safeguard the financial well-being of future generations.

Innovative strategies for enhanced investor engagement

To address these challenges and foster stronger connections with younger investors, wealth management firms should consider implementing the following comprehensive strategies:

- Demystify financial concepts and cultivate financial literacy: Develop and disseminate educational resources, interactive tools, and engaging content that breaks complex investment concepts into easily digestible, jargon-free language. This approach can help build confidence and competence among younger investors.

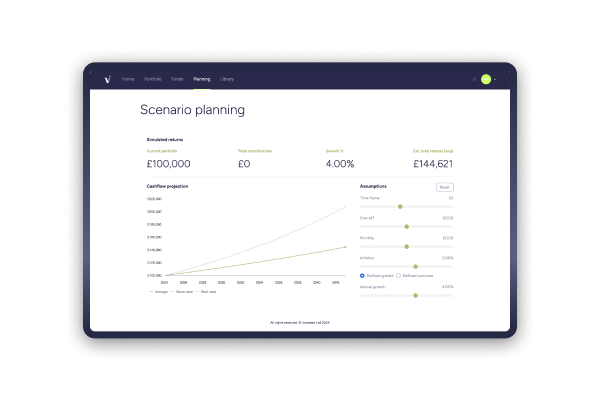

- Promote and reinforce positive financial behaviours: Design and implement innovative programs that not only incentivize regular saving and investing but also vividly demonstrate the long-term benefits of these practices. Utilize data visualization tools and scenario planning to illustrate the power of compound interest and consistent investing.

- Embrace a comprehensive digital-first philosophy: Develop and deploy intuitive, user-friendly mobile applications and online platforms that simplify portfolio monitoring and make financial management an engaging, even enjoyable, experience. Incorporate gamification elements to encourage regular interaction with financial information.

- Offer tailored guidance and personalised financial coaching: Implement AI-driven coaching services and provide customised advice that addresses individual financial goals, risk tolerances, and life circumstances. This personalised approach can help younger investors feel more empowered and in control of their financial destinies.

- Champion radical transparency in financial services: Adopt a policy of complete openness regarding fee structures, investment strategies, and potential risks. Utilise clear, concise communication to build trust with younger investors who may be skeptical of traditional financial institutions.

- Emphasise and facilitate values-aligned investing: Develop and promote diverse, sustainable, and socially responsible investment options. Provide detailed information on the environmental, social, and governance (ESG) impacts of various investments to appeal to the values-driven mindset of younger generations.

Wealth management firms can effectively bridge the engagement gap with younger investors by implementing this multifaceted approach. These strategies address current pain points and lay the foundation for fostering long-term, mutually beneficial relationships between financial institutions and the next generation of investors. As the economic landscape evolves, adaptability and responsiveness to changing investor needs will be key to success in the wealth management industry.

Invessed for enhanced investor engagement

Invessed's Wealth Engagement Platform aligns closely with the strategies for enhanced investor engagement, addressing the challenges identified in the survey:

- Financial literacy and demystification: Invessed's platform emphasises simplified language and educational tools, helping wealth managers bridge the knowledge gap and increase client engagement. This directly addresses the 42% of younger investors who are uncomfortable with basic investing principles.

- Promoting positive financial behaviours: The Client Experience suite offers real-time valuations and performance reporting, encouraging more frequent portfolio monitoring. This feature targets the 61% of younger investors who don't regularly monitor their portfolios.

- Digital-first approach: Invessed offers digital-first client apps and portals, aligning with the preferences of younger generations more comfortable with technology. This approach attracts 56% of younger investors who hesitate to seek traditional financial advice.

- Personalised guidance: The Advisor Productivity suite enables wealth managers to offer tailored advice and support at scale, more effectively addressing individual client needs. This personalisation can help the 51% of younger investors who feel they have little control over their finances.

- Transparency: Invessed promotes transparency through clear reporting and insights, helping wealth managers build trust with clients skeptical of traditional advisory services. This transparency is crucial for engaging the 56% of younger investors who won't seek advice due to high fees or outdated practices.

By incorporating these features, Invessed's platform provides wealth managers with the tools necessary to effectively engage younger investors, address their specific needs and concerns, and ultimately foster long-term relationships in the evolving landscape of wealth management.

Conclusion

The wealth management industry is at a critical juncture, facing the challenge of engaging and empowering a new generation of investors. Our 2024 survey has unveiled significant financial literacy, engagement, and confidence gaps among younger investors, presenting challenges and opportunities for wealth management firms.

By embracing innovative digital-first approaches, personalised guidance, and transparent communication, the industry can bridge these gaps and foster stronger connections with Gen X, Millennial, and Gen Z investors. Platforms like Invessed lead this transformation, offering tools and solutions directly addressing younger investors' needs and preferences.

As we look ahead, it's evident that the future of wealth management hinges on adapting to evolving investor needs and expectations. By prioritising financial education, harnessing technology, and providing tailored values-aligned investment options, wealth management firms can engage younger investors and empower them to take control of their economic destinies.

The journey from disengagement to empowerment may be challenging, but it promises to reshape the financial landscape for generations. As the industry evolves, those who can effectively connect with and serve younger investors will be well-positioned to thrive in this new era of wealth management.