So far, the investment industry has avoided disruption by Big Tech, but competition is beginning to emerge in the form of financial super apps

Key points

- So far, the investment industry has avoided disruption by Big Tech

- Competition is beginning to emerge in the form of financial super apps

- Incumbent firms can defend their position if they play "digital offence"

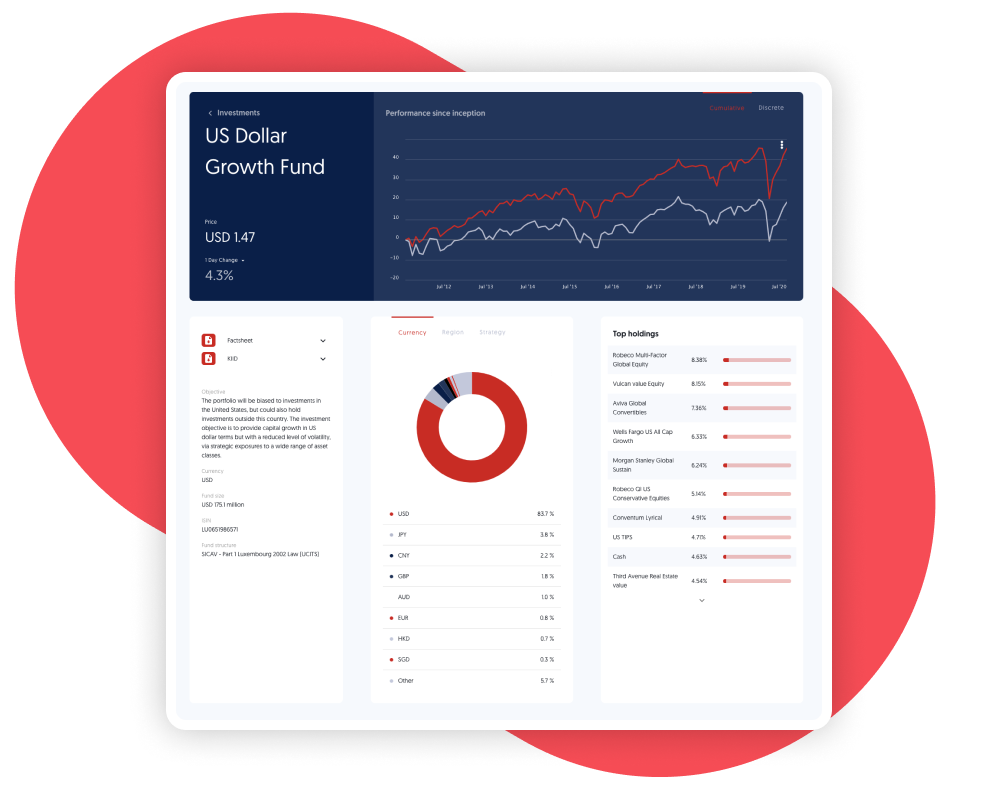

- Sophisticated digital-first Client Reporting is a key capability

Ripe for disruption?

Retailing will never be the same after Amazon, neither will advertising after Facebook and Google. Big Tech firms have reimagined entire industries, upending their competitive structures with a mix of data-enabled services and customer-centricity.

So far, Big Tech's foray into financial services has been limited to payments. Challenger banks and robo-advisors have made some splash, but they have not caused the level of disruption that would worry incumbent firms. This could be about to change.

Enter the financial "super apps"

Financial "super apps" have been mainstream in China for a while. Building on "base" services (chat, social, commerce), providers like WeChat and Alibaba bundled in payments, banking, and even investing. In 2020, Ant Financial (bundling in an investment platform), became the world's biggest FinTech, before regulators reigned it in.

More familiar brands are beginning to move in that direction. Starting with payments, PayPal, Stripe, and Square (which could be bundled with Twitter), financial super-apps are in active development. Payments and banking might be the starting point, but the juicy margins of the investment management industry are in their sights.

Play digital offense

How can Wealth and Asset Managers protect their business? While disruptors have tapped into clients' demand for innovation-driven convenience, the relentless pursuit of scale often results in bland and impersonal client service.

The adage that the best defence is attack holds true here, investment brands should play "digital offense", matching convenience without losing their edge in personal service. Client Portals are the best response to the "solution app". Client Portals are a convenient medium for investors that shine a light on the brand’s distinct personality and USPs.

“Super apps” can be as bland as out-of-town discounters. Bring your point of difference into your Client Portal App and show your investors how your values align.