Investors are after decent returns, low fees and great service. What they need is a platform that protects their data and inspires trust

On a previous post, I explained how we help firms reimagine customer experience by decoupling or rearranging touchpoints on the Investor Value Chain. We use that model to encourage creative thinking and help our clients identify areas of improvement or even innovation.

However, a key element of CX is trust. Across financial services, data security is a major concern and a key element of regulatory compliance, with provisions in GDPR and MiFiD II. Your platform must protect data and inspire trust on every touchpoint and every step of the value chain.

Awareness

Wealth Managers generate most of their business through referrals, whereas Fund Managers tend to go via distributors. Either way, the first branded touchpoint is your website, and first impressions count: maintaining a polished lead-gen website is the first step to inspiring trust.

Selection

Having made first contact with your firm, prospects will typically find residence in your CRM for the sales team to follow up on. With personal information, GDPR comes into play and you need to keep track of the entire data flow to ensure that prospect data is secure from unauthorised access.

On-boarding

During on-boarding personal data gets really personal and security provisions need to be accordingly robust. For most organisations the most appropriate avenue will be one of the big Cloud providers. Our platform is entirely built and optimised for the Azure Cloud,which benefits from Microsoft’s $1bn annual cyber-security investment.

Service delivery

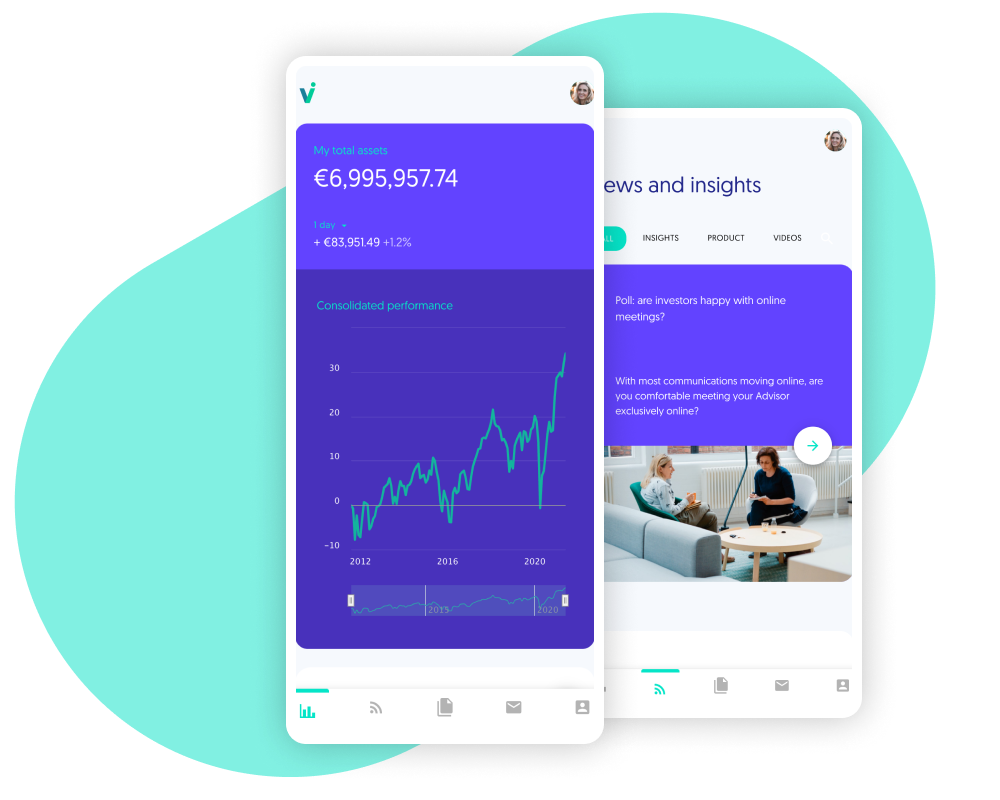

Modern experiences are a network of integrations - drawing data from CRMs, data providers and document repositories. This decoupled architecture is not only efficient but also secure. When it comes to service delivery and reporting, the experience layer acts as a “pass-through” messenger, giving you one less system to worry about.

Account management

Data breaches are making headlines, but we must not forget that the alternatives are worse: phone calls, letters and even email can be intercepted and manipulated by malicious actors. For account management tasks, it is best to rely on a messaging service, that features end-to-end encryption and multi-factor authentication.

Next steps

Cyber-security is major concern in investment management even for non-transactional systems. Our platform is architected, developed and delivered with security in mind, and can help you build trust across the investor value chain.

If you have concerns over the security of your legacy systems, or customer loyalty suffers due to lack of trust, do get in touch for a discrete and solution-oriented discussion.