Why behavioural data should be a key aspect of your Data under Management and technology strategy

In a previous post, we discussed how Wealth Managers are facing disruption from Big Banks, FinTech or Big Tech. In this environment, incumbents can compete using their existing account and portfolio management experience - but only if they can offer a mature digital customer experience.

A key component of this proposition is data. As it includes all the interactions leading to - and resulting from - asset management, it is wider than AuM. In fact, we advocate a new measurement of success as Data under Management (DuM).

When considering a firm’s DuM, special attention must be given to behavioral data, a source of great value to the organization.

What is behavioural data?

Behavioral data is essentially metadata for all interactions between the organization and its customers - logins, clicks, downloads, messages, meetings, events etc.

What is important for behavioral data is not the content but the context. We do not need to track the content of a PDF download, but its classification (the type of document, related asset class, date published…) and its position in the user journey (e.g. was it triggered by an email or was it unprompted; was it followed swiftly by an irate message?).

How do you source this data?

The first step is to make sure you track everything. Starting with the digital domain, ensure that all buttons and page views are tracked and timestamped. In the offline world, track office visits and event attendance. Ensure your Client Service teams track actions in a CRM.

Obviously, GDPR and security are key here. Your T&Cs need to make clear that activity will be tracked - this is no different from demanding that visitors sign in at reception. For cost purposes, behavioural data will probably be stored externally - so make sure it is anonymised but stamped with an identifier that can match it to an individual later on.

How do you extract value from behaviour?

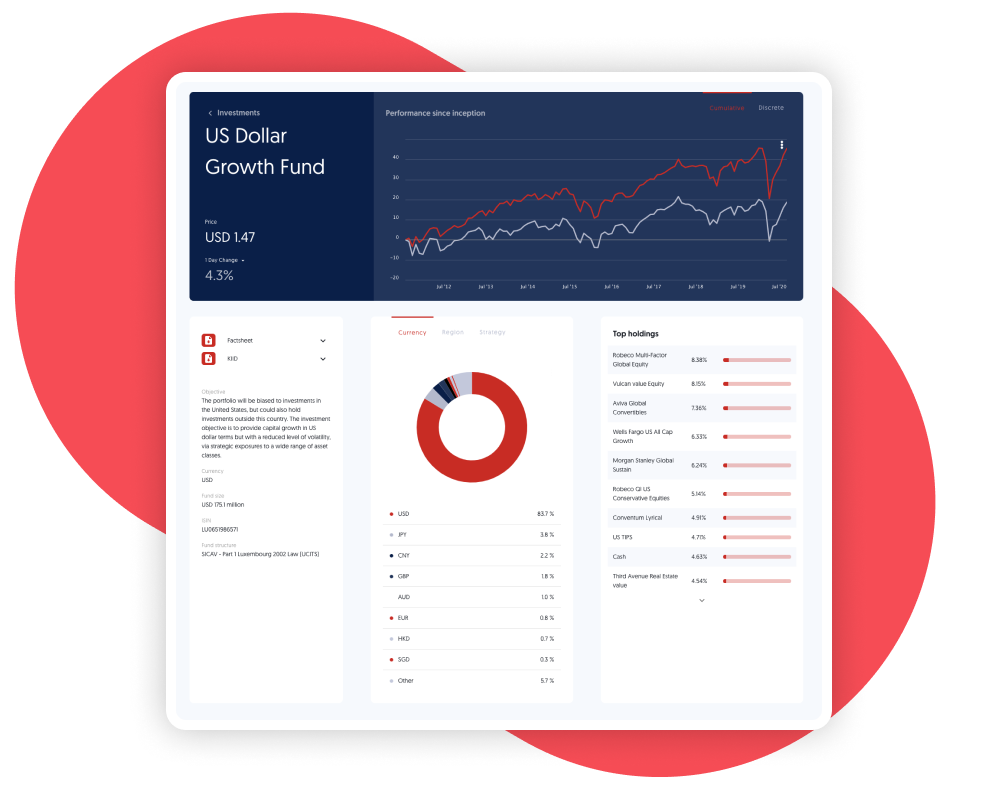

The most obvious source or value is optimisation. By monitoring aggregate engagement on a Dashboard, you can fine-tune user experience. Secondly, you can increase Customer Life Time Value (LTV) by supporting your customers - building trust, loyalty and advocacy.

At a later stage, you can use behavioral data to drive personalization - the ultimate goal of proactive experience, and a key strength of BigTech firms. Using your data to train ML models, you can extract patterns and enable your advisors to personalize customer experience like never before.

Data is slipping away. Act now!

Behavioral data is a key aspect of your Data under Management and a great source of long-term value. To extract this value, you need volume - so every untracked interaction is value lost. If you think that data is slipping through your fingers, get in touch with us today.