Wealth Management Software Challenges

- Integration complexity with legacy systems and multiple data sources

- Ensuring data security and compliance with evolving regulations

- Providing personalised client experiences at scale

- Adapting to market changes

- Adapting to increasing demand for mobile and digital-first solutions

Invessed Benefits?

- Save Time & Automate Processes: Reduce reporting tasks by up to 75%, freeing you to focus on client relationships

- Increase Client Satisfaction: Offer 24/7 access to tailored reports through our user-friendly client portal

- Enhance Decision Making: Leverage real-time analytics and AI-driven insights for smarter wealth management

- Ensure Compliance: Stay ahead of MiFID reporting requirements with built-in compliance features

- Scale Your Business: Our cloud-native platform grows with you, supporting your expansion goals

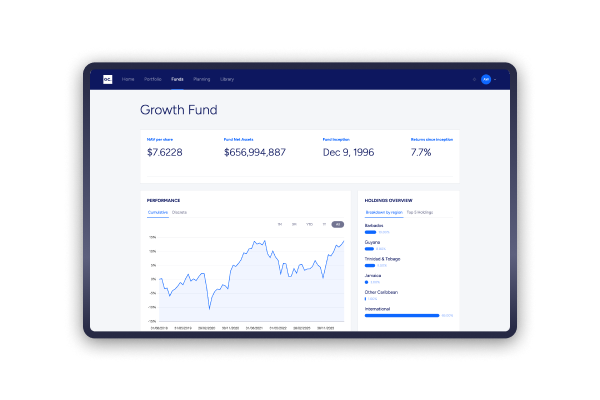

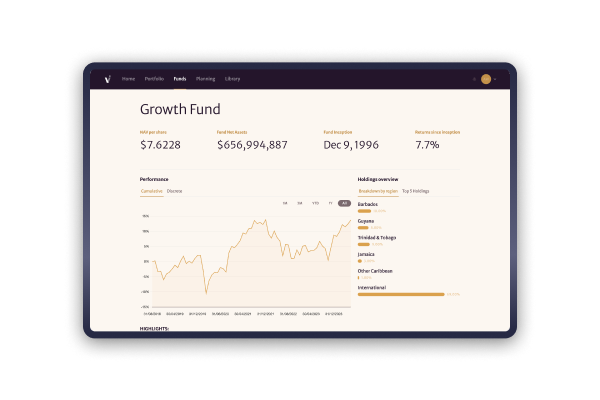

Advanced Wealth Management App

Do you need help modernising outdated wealth management software, inconsistent data, and time-consuming manual processes? Invessed's state-of-the-art client portal is designed to modernise your portfolio reporting practices and streamline your operations.

"Invessed has transformed our investment reporting process, allowing us to focus more on client relationships and strategic growth. It's an indispensable tool for modern wealth management."

Comprehensive Wealth Management Apps and Client Portals

- Automated Data Integration: Seamlessly aggregate portfolio data from multiple sources, ensuring accuracy and consistency in your fund reports.

- Customisable Reporting: Create tailored investment reports that meet clients' unique needs, enhancing engagement and satisfaction.

- Real-Time Analytics: Access up-to-the-minute portfolio performance insights for informed decision-making and proactive wealth management.

- Compliance Support: Stay ahead of MiFID reporting requirements with built-in compliance features and audit trails.

- Client Portal: Provide your investors with 24/7 access to their investment information through a user-friendly interface adaptable to all devices.

Enhanced Client Engagement

Invessed's Wealth Engagement Platform aligns closely with strategies for enhanced investor engagement, addressing challenges identified in our 2024 survey:

- Financial literacy: Invessed simplifies investing concepts, bridging knowledge gaps for wealth managers. This tackles the 42% of young investors who are uncomfortable with basic principles.

- Real-time insights: Our Client Experience suite offers instant valuations and performance data, promoting active portfolio engagement. This addresses the 61% of younger investors who rarely monitor their investments.

- Digital-first approach: Our platform offers modern client apps and portals, appealing to tech-savvy younger investors. This addresses the 56% who avoid traditional financial advice methods.

- Personalised guidance: Our Advisor Productivity suite enables tailored advice at scale, addressing individual needs. This helps engage the 51% of younger investors feeling financially uncertain.

- Transparency: Invessed promotes clear reporting and insights, building trust with skeptical clients. This helps engage younger investors who often avoid traditional advisory services due to perceived high fees or outdated practices.

Why Choose Invessed?

Invessed stands out as the solution of choice for forward-thinking wealth management firms:

- Cost-effective: Why build when you can rent? Save on development and maintenance costs

- Proven expertise: Backed by years of experience in wealth management technology

- Customisable: Tailor the platform to your unique needs and branding

- Future-proof: Continuous updates and improvements to stay ahead of industry trends

- Continuous tech support: Invessed tech specialists will take care of your portal and app, guaranteeing uptime

Are you ready for Invessed?

Don't let outdated systems hold you back. Experience the power of Invessed and take your wealth reporting to new heights.