Capture client risk profile and match with funds and model portfolios.

Offering investment advice at scale is a key challenge for many wealth and fund management firms that target investors directly.

Invessed offers tools to help you capture risk appetite, match it to investment products, provide projections and plot them against scenarios and objectives.

Investment reporting on over €200Bn combined AuM

Risk profiler

Capture risk appetite through a series of questions and intuitive questionnaires.

Sync risk profile with your CRM, to ensure advisors have up-to-date picture of client needs.

Make product recommendations at scale by matching profiles with model portfolios and funds.

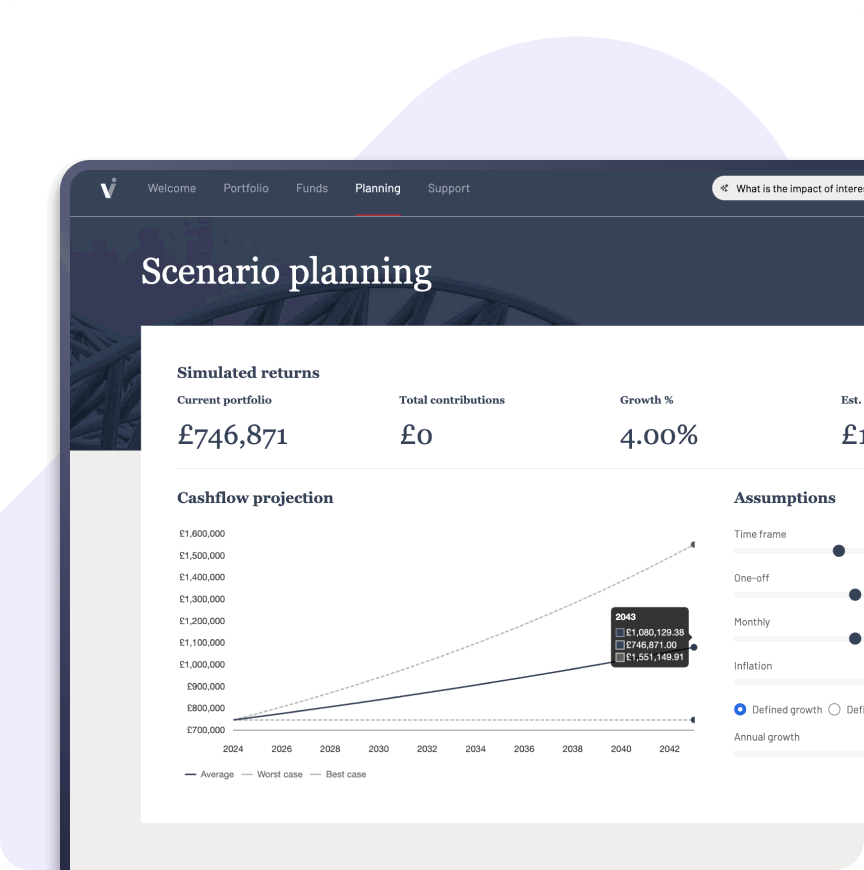

Growth projections

Run growth simulations of model portfolios based on historical returns and other assumptions.

Initiate trades and track progress against projections or benchmarks.

Set timeframe, lump sum and regular contributions for accurate illustration of potential outcomes.

Map to client objectives

Outcome-driven investment advice, by matching contributions against targets.

Cross-reference fees, ESG and other criteria, for a fully transparent advisory service.

Map outcomes on life milestones for an engaging, story-led wealth growth approach.

We are not keen on robo-advice, but making recommendations at scale is a game-changer.

South-Europe Wealth Manager, €2Bn AuM

Book a demo for the Invessed Client Engagement Platform

Learn how our platform can transform your business.

Investment Advice FAQs

Invessed gives your clients intuitive tools to explore their investment preferences and expectations. It presents data clearly and interactively, helping firms build trust through transparency and user control.

Yes. Invessed is fully customisable to your brand identity—logos, colours, typography and tone; so your client experience stays consistent and professional across all channels.

By streamlining data collection, risk profiling simulations and reporting into a single, secure platform, Invessed supports scalable, compliant investment journeys that keep clients engaged and reduce operational friction.

Clients can explore projected growth scenarios and historical data using clean, visual modules. These aren’t recommendations, they’re tools that help clients and advisors have more informed conversations.

Invessed surfaces valuable client insight from engagement patterns to journey drop-offs, giving marketing teams a clearer picture of what’s working and where to optimise.

Invessed offers a suite of APIs and supports custom integrations with CRMs, reporting tools and data providers. It’s built to fit around your ecosystem, not the other way around.

Invessed is cloud-native and ISO 27001-certified. It uses secure data protocols, encryption and multi-factor authentication to protect client data and meet regulatory requirements.

Yes. Invessed runs on scalable cloud architecture and is designed to handle high volumes of users and data without performance dips, so you can grow confidently.

Data flows in real-time across integrated systems, minimising duplication and manual effort. This ensures Invessed wealth managers and clients always see the most up-to-date information.

Absolutely. Invessed is built for mobile responsiveness and also supports native mobile apps, ensuring seamless access across devices.