Featured in

About Invessed

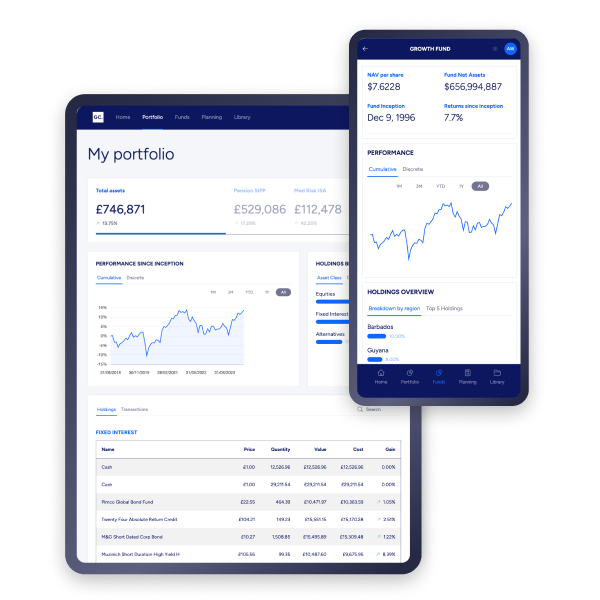

Invessed provides asset and wealth managers with innovative solutions to engage clients effectively. These include a secure client portal and mobile application featuring extensive wealth reporting tools. Built on a cloud-native platform, Invessed improves wealth and asset management processes by delivering robust engagement and management solutions, simplifying client interactions and financial oversight.

Invessed offers a scalable, modular platform that addresses key challenges for asset and wealth managers. It solves lengthy development cycles, simplifying complex integrations and maintenance. Additionally, it ensures consistent brand identity and allows customisation to meet unique business requirements. This facilitates easier management and expansion of digital services.

Why cover Invessed?

Unlike traditional wealth technologies, the Invessed platform helps firms manage wealth at scale by streamlining processes, which leaves more time for client interaction and strategic planning.

Invessed integrates seamlessly with modern systems, simplifying the process for wealth managers and their advisors to share information. They can also receive client feedback through Advisor tools that range from intuitive investment portfolio reporting to risk profiling.

Theo Paraskevopoulos, Co-Founder and CEO, has 25 years of industry expertise and a forward-thinking perspective on how technology can enhance asset management.

Explore how future tech is transforming the landscape for investors and fund managers

Covering Invessed and featuring insights from Theo Paraskevopoulos provides an opportunity to explore how future tech is transforming the landscape for investors and fund managers alike, driving greater transparency, improved decision-making, and enhanced client relationships in an industry that needs digital disruption.

Theo can offer valuable perspectives on the next wave of advancements in financial technology, highlighting Invessed’s role at the forefront of this transformation.

Advisors can manage their business using a modern platform with the latest technologies. The Invessed platform delivers investment portfolio reporting, analytics, and onboarding solutions through branded apps and secure client portals.

Reasons to cover

UK financial literacy

Join Theo in exploring the landscape of financial literacy in the UK and discover how enhancing knowledge in this area can lead to improved financial decisions.

UK financial resilience

Theo can investigate the diverse elements influencing financial resilience in the UK and present innovative strategies and solutions bolstering financial security against uncertainty.

Generational attitude gaps in investing

Speaking with Theo will help you understand the changing investment perspectives among different age groups. You can explore how these shifts are affecting market trends and investment strategies.

Generational wealth gaps

Learn from Theo about the widening wealth gaps between generations in the UK and what it means for the future of financial planning and wealth management.

Trends in asset and wealth management

Theo can unpack the latest trends shaping asset and wealth management and how these developments enhance investment approaches and strategies.

Fostering positive client relations

Theo can guide the best practices for establishing and sustaining positive client relationships, which are essential for the future of wealth management.

Practical implications

Theo can offer a real-world perspective on how AI can be leveraged practically and effectively within the finance department, impacting day-to-day operations and long-term strategic planning.

Invessed at a glance

Personalised client reporting

Invessed offers dynamic and interactive investment reporting for private, retail, and institutional investors. The platform consolidates accounts, making it easy to drill down into portfolios, holdings, and securities. Invessed also provides a suite of investment charting and visualisations. It also uses document libraries and data rooms for public and personalised file exchanges.

Action client insights

Invessed analytics helps understand client behaviour and unlocks the hidden value in data. By engaging with clients through digital channels, Invessed accumulates a wealth of behavioural data that can boost personalisation and drive business growth.

Scale investment advice

Invessed captures client risk profiles and matches them with funds and model portfolios. Providing investment advice on a large scale is a significant challenge for many wealth management firms targeting direct investors. Invessed offers tools that capture risk appetite, match it with appropriate investment products, project potential returns, and align them with various scenarios and objectives.

Distribute fund data

Invessed streamlines fund reporting using interactive fund factsheets and seamlessly distributes fund data to advisors and investors

Connect tooling

Invessed integrates into existing data through its Bring-Your-Own-Data approach, ensuring seamless compatibility with current systems. With a design focused on extensibility, Invessed’s APIs enable smooth data integration to and from various systems. They also accelerate development through pre-built integrations for Microsoft Dynamics, Salesforce, HubSpot, Xplan, and other leading asset management CRMs.

Maximise engagement

Invessed simplifies client onboarding through its secure portal, making the process less resource-intensive for retail and professional investors. Email often lacks the necessary security for complicated, multi-step procedures. Invessed solves this issue with secure messaging centres and document libraries that streamline onboarding and lifecycle management. This leads to efficient account document distribution, KYC and AML materials collection, and acquisition of e-signatures.

Multi-channel customer experience

Invessed’s wealth management mobile apps offer a convenient and personal experience that websites can’t compare to. With biometric authentication, these native apps combine high-level security with outstanding usability.

Scale to demand

Invessed leverages the power of Microsoft Azure and Google Cloud to offer highly secure and scalable portals with cloud-native agility. As an ISO 27001-accredited company, Invessed guarantees exceptional security and privacy for wealth platforms. It utilises advanced technology and DevOps practices to adapt and scale according to individual requirements.

Theo Paraskevopoulos, Co-founder and CEO

Few individuals navigate the intersection of business, technology, and client experience as skillfully as Theo Paraskevolpoulos.

Since the early 2000s, Theo has pioneered user experience within the City of London’s financial district. He co-founded FundWorks, a startup that offers essential reporting solutions to industry leaders like JP Morgan, Investec, and BNY Mellon.

Theo first observed the finance sector’s practice of overwhelming clients with data instead of engaging them through narratives. The advent of innovations like the iPhone, which allowed clients to carry their portfolios in their pockets, further highlighted this trend.

Rather than adapting to this change, the industry used “compliance” as an excuse to resist evolution. This led to a stifling of innovation and disengagement of clients, inspiring Theo to take action.

Through Invessed, Theo aims to enhance investor relationships. He is committed to helping companies in the Asset and Wealth Management sector adjust to the evolving demands of modern clients.

Alongside his co-founder, Adam Weston, he has built a platform that uses advanced technology to deliver unique, customisable solutions that enhance consumer experiences and ensure more positive investor relations.

Before Invessed, Theo and Adam founded GrowCreate in 2012. They built a mature, sustainable digital solutions agency from scratch, establishing a presence in three countries and acquiring a broad European client base.