Challenges in Switching Software Providers: A Decision Maker's Dilemma

If you're reading this article, your firm is probably frustrated with its client portal and considering replacing legacy software. The good news is that you're not alone. Many firms face common issues with their existing software, from poor Customer Experience (CX) to outdated interfaces.

We have found that firms switch providers for reasons ranging from limited features to disrupted business operations. The process of updating current apps and data by migrating to a cloud-first platform like Invessed will align with future business needs. However, the challenges in doing so are well documented. You should ask vendors the questions you need answered to make an informed decision. But what are they?

Regardless of my overview below, the bottom line could still be cost. If you are tied to a contract and considering breaking it for a proven ROI, you need to be asking the right questions.

Below is a list of common issues our clients have had with their existing client portal prior to moving to Invessed.

- High Maintenance Costs: Legacy software incurs high maintenance fees and requires frequent, costly updates.

- Outdated Interface: Many firms struggle with an outdated, unintuitive user interface that hampers user adoption and satisfaction.

- Lack of Integration: Existing software may not integrate well with other essential tools and systems, leading to operational inefficiencies.

- Poor Customer Support: Inadequate and unresponsive customer support can lead to prolonged downtime and unresolved issues.

- Limited Features: Legacy systems often lack the advanced features and functionalities that modern platforms provide.

- Security Concerns: Older software may not adhere to the latest security standards, posing data integrity and compliance risks.

- Slow Performance: Many firms experience slow performance and frequent downtimes with their current software, disrupting business operations.

- Complex Data Migration: Transitioning data from legacy systems can be cumbersome and error-prone.

- Rigid Contracts: Existing contracts may have inflexible terms, including long-term commitments and high termination fees.

- Inconsistent Updates: Legacy providers may not offer regular updates, leaving firms with outdated technology.

- Stakeholder Frustration: Staff, management, and clients may express dissatisfaction with the current system, making it difficult to gain buy-in for continued use.

- Lack of Scalability: Legacy software may not scale effectively with business growth, limiting future capabilities.

Our clients tell us that these negative experiences underscore the need for a more reliable, feature-rich, and user-friendly client portal solution like Invessed. What do you think?

Invessed's Solutions to Mitigate Transition Challenges

Invessed offers solutions to address these challenges head-on, making the transition as seamless as possible.

- Early Termination Fees and Penalties: Invessed’s cost-effective software and support help offset early termination costs.

- Transition Costs: A comprehensive onboarding package from Invessed includes implementation support, training, and resources, minimising transition costs.

- Data Migration and Integration: Invessed's data migration team ensures all data is securely transferred and integrated with existing financial tools.

- Time and Resource Allocation: A detailed project plan and dedicated project manager streamline the transition, allowing your team to focus on core activities.

- Learning Curve: Extensive training and support help staff and clients quickly adapt to the new platform and maintain productivity.

- Risk of Disruption: A phased transition approach minimises service disruptions, ensuring business operations and client satisfaction remain unaffected.

- Ensuring Compliance: Invessed adheres to industry regulations, assuring compliance during and after the transition.

- Vendor Reliability: With a proven track record of reliability, Invessed ensures consistent service delivery.

- Customer Support and Service Quality: Customer support and a dedicated account manager address issues promptly.

- Long-Term Commitment: Flexible contract terms without long-term lock-in periods provide future adaptability.

- Stakeholder Buy-In: Detailed information and resources from Invessed help communicate the benefits of the transition to stakeholders.

- Impact on Clients: A collaborative communication plan ensures clients are informed about the changes, maintaining trust and satisfaction.

The Case for Switching to Invessed

As an advisor, you understand the importance of providing clients with a modern, user-friendly experience. If your current client portal is outdated and suffers from low user adoption, here’s why you should consider transitioning to the Invessed wealth engagement platform:

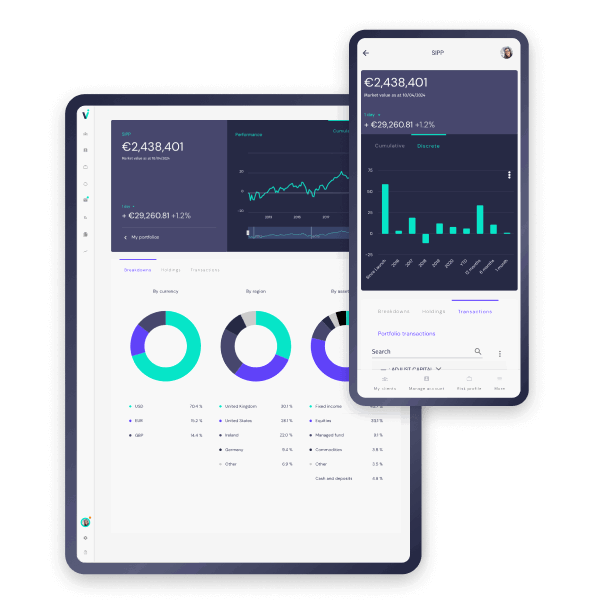

- Enhanced User Experience: Invessed offers a cutting-edge, intuitive interface that significantly improves user adoption and satisfaction.

- Advanced Features: The platform includes innovative features tailored to advisors and clients, such as personalised dashboards, real-time analytics, risk profiling, and seamless integration.

- Cost Efficiency: While breaking your current contract may involve costs, long-term savings, and increased client retention can offset these expenses.

- Superior Support: Exceptional customer support ensures issues are promptly resolved, minimising downtime.

- Regular Updates and Innovation: Continuous innovation and updates ensure access to the latest features and security enhancements.

- Scalability: The platform accommodates business growth, easily expanding services without compromising performance.

Key Considerations When Breaking a Contract

Switching software providers is a significant decision that can positively impact your firm's operations and client satisfaction. When evaluating whether to break your legacy client portal software contract in favor of a modern solution like Invessed, it is essential to carefully weigh the benefits and drawbacks. This section will guide you through key considerations to help you make an informed decision.

When contemplating the switch, consider the following questions:

- What are the early termination fees or penalties?

- How long will the transition process take, and what are the potential disruptions?

- What is the total cost of switching, including implementation?

- What new features and functionalities does the provider offer?

- How will the new provider ensure data security and compliance?

- What kind of customer support does the new provider offer?

- How frequently does the new provider update their software?

- Is the new platform scalable?

- Can the new platform integrate with existing tools?

- What are the experiences of other firms that have switched?

- What training does the new provider offer?

- How will the switch impact clients?

- Are there long-term commitments with the new provider?

Key Considerations When Staying with the Current Provider

When considering whether to stay with your current provider or upgrade to a new one, thoroughly evaluating the potential benefits and drawbacks is important. In this section, we will explore key considerations to help you assess whether staying with your current legacy client portal provider is the right decision for your firm.

If considering staying with your current provider, ask yourself:

- What are the benefits of staying?

- Is the client experience exceptional?

- Does the current software help grow the business?

- Is the business at risk of losing clients because of legacy technology?

- What is the total cost of remaining, including enhancements?

- What is the firm's experience with the customer support provided by the current provider?

- Is the current provider frequently updating their software?

- Are there upcoming features that could address concerns?

- Is the current platform scalable?

- How well has the current platform integrated with existing tools?

- Why is the firm considering leaving the current provider?

Weighing the Benefits and Drawbacks

When deciding whether to stay with your current provider or break your contract for a new one, it is essential to thoroughly evaluate the benefits and drawbacks of each option. By carefully considering key factors, your firm can make an informed decision that aligns with its goals and ensures the best possible outcome for both your operations and client satisfaction. Here are some critical points to weigh in this important decision-making process:

Breaking a software contract can yield several benefits:

- Better Features and Functionality: New providers may offer more advanced features.

- Cost Savings: New contracts might be more cost-effective.

- Improved Support: Superior customer support can reduce downtime.

- Innovation: Regular updates ensure access to new features.

- Scalability: New software can better accommodate business growth.

The point of this article is that breaking a software contract can offer significant benefits, including better features, cost savings, and improved support. However, early termination fees, the effort required to switch providers and potential operational disruptions must be carefully considered. By thoroughly assessing these factors, your firm can make an informed decision that aligns with its long-term goals.

The need for a modern, intuitive, and feature-rich client portal cannot be overstated. Invessed offers a solution that addresses the challenges posed by legacy systems. With Invessed, you get a user-friendly interface, advanced features, seamless integration, and exceptional customer support—all crucial for maintaining client satisfaction and operational efficiency.

Switching to Invessed solves the issues associated with outdated software and sets your firm on a path to growth and innovation. The platform's scalability, regular updates, and compliance with industry standards ensure your firm stays at the forefront of technology and security.

By choosing Invessed, you're making a strategic investment in your firm's success, enhancing both client experience and operational capabilities. Make the switch today and experience the Invessed difference.