Digital strategy leaders face a new challenge: navigating a WealthTech landscape while making long-term, value-led decisions. The WealthTech100 2025 gives us more than a list of innovative companies – it highlights where capital, attention and opportunity converge.

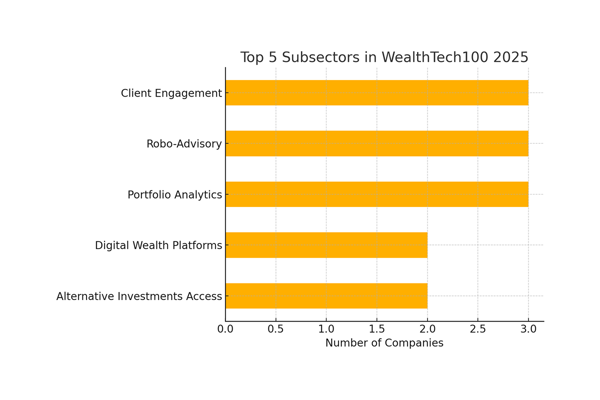

We analysed the list by founding year, employee size and subsector to pinpoint which segments show the clearest signs of traction. Here's where the smart money is heading.

Young, focused, and ready to scale

More than half the firms on the WealthTech100 list were founded after 2015. These aren't early-stage experiments – they're fast-moving, often bootstrapped teams with sharp propositions and lean delivery models.

The subsectors with the youngest average founding years:

- Client Engagement Platforms (avg. 2016.7)

- Portfolio Analytics (avg. 2016.3)

- Alternative Investment Access (avg. 2016.0)

This is where product-market fit is evolving, shaped by changing investor expectations and digital-first service models.

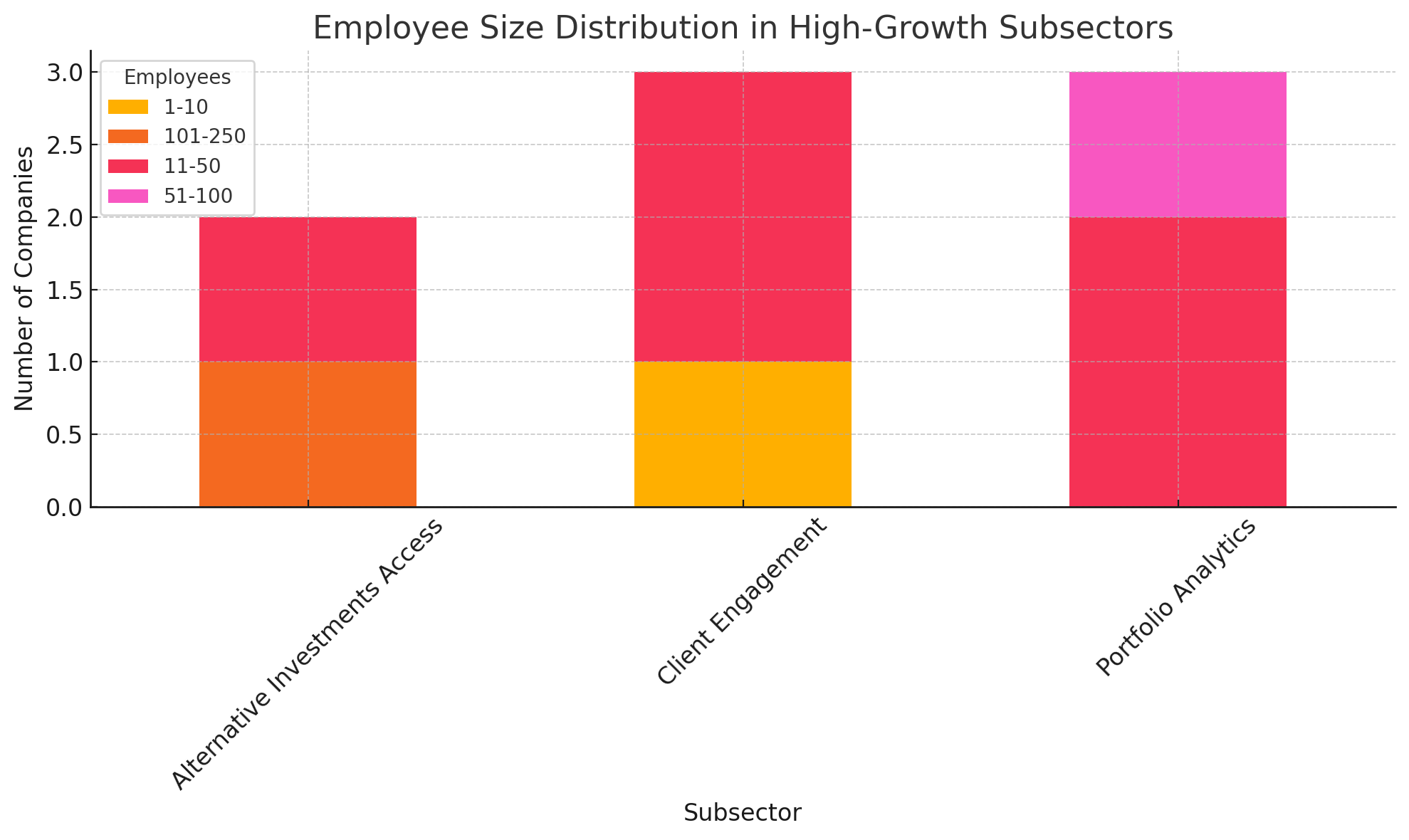

Scale doesn't mean size – it means focus

Most companies in high-growth segments like engagement and analytics employ under 250 people. Clarity matters more than headcount: tight use cases, deep integrations and data-backed personalisation.

Digital strategy leads can draw two clear conclusions:

- Integration-ready, modular tools are outperforming big platforms

- Investment is shifting from infrastructure to client experience

Subsector maturity reveals breakout potential

Specific segments are maturing faster, attracting more attention from investors and acquirers alike. Client Engagement, in particular, stands out as a breakout category – driven by the demand for richer, more responsive client journeys.

Firms here are winning because they deliver:

- Real-time, data-driven UX

- Low-friction onboarding and reporting

- White-labelled solutions that enhance brand visibility

For digital strategists and Heads of Innovation, this is a signal to invest in platforms that don't just digitise operations but massively improve the client experience.

How Invessed fits in

Invessed is part of this new breed of WealthTech: lean, integrated and hyper-focused on client engagement. Our platform is built for digital leaders who want to:

- Deliver branded, personalised experiences

- Integrate seamlessly with CRM, PMS, and analytics tools

- Scale digital channels without scaling complexity

We're not just a client portal provider. We're a strategic partner helping firms grow loyalty and lifetime value through digital experience.

The opportunity now

The WealthTech100 shows where innovation is winning. For VC partners, Heads of Innovation and Strategy Leads, it highlights which solutions are shaping the industry's future.

Invessed supports that journey. If you're building a future-proof digital strategy that puts client experience at the centre, let's talk.

Explore Invessed or Request a Demo to learn how we can help you lead the next wave of WealthTech success.