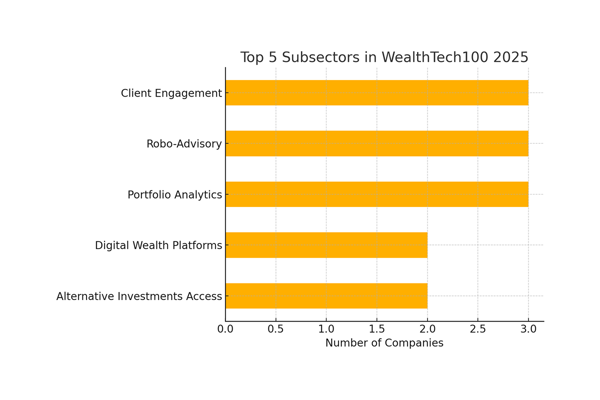

Each year, the WealthTech100 reveals which companies are pushing boundaries and what those boundaries are. And in 2025, the message is loud and clear: the future of wealth lies in client experience.

Beyond the AI hype and digital transformation buzz, the shift is human-centric. Investment managers are asked to rethink how they serve, not just advise their clients. And the technology rising to the top reflects this change.

At Invessed, we're proud to say this isn't a direction we're chasing. It's one we've championed from day one.

What's really driving innovation?

Looking across the WealthTech100 list, the most compelling platforms share a common thread: they enable deeper understanding, stronger relationships and greater transparency.

AI that adds value

Firms like 3AI help asset managers uncover hidden alpha by processing more data, more deeply, than any team of analysts ever could. But the goal isn't automation. It's augmentation.

Invessed's approach: Explainable AI supports both clients and advisors, helping them have better, data-informed conversations—without needing to decode the black box.

Seamless, connected journeys

Companies like Additiv focus on enhancing the entire Experience rather than just certain aspects. They integrate onboarding, planning, and reporting into cohesive, user-focused systems.

Invessed's approach: Our platform brings together investment data, client communications, secure document sharing and powerful analytics all in one branded, safe environment.

"Tech is no longer a back-office enabler—it's now the frontline of the client relationship."

Personalisation at scale

Platforms are redefining the meaning of "personalisation" by offering highly customisable, data-rich reporting tailored to individual needs and preferences.

Invessed's DNA: From investor-type dashboards to dynamic report templates and multilingual capabilities, we build personal experiences at every touchpoint.

"Clients don't search by filters—they ask questions. Now your platform can answer."

Natural Language Search is the new gold standard

Invessed's integrated Natural Language Search (NLS) allows clients to engage with their data the same way they think:

- How did my portfolio perform last quarter?

- What are my top-performing holdings this year?

- Show the impact of ESG on my international equities.

NLS is built on intelligent language models, and it's simple, confident and automated while delivering secure, compliant results every time.

This is the future of digital engagement: search that feels human and results that feel empowering.

What clients expect in 2025

Transparency with narrative

Clients want to know what's happening with their wealth, and why. The era of "more data" has passed. They now expect context, story and clarity.

Tailored experiences

From custom dashboards to regional compliance views, experiences must reflect each client's reality, no matter how complex their structure or holdings.

Anywhere, anytime access

24/7 access is table stakes. Clients want frictionless interaction across devices and in multiple languages without compromising security or clarity.

Digital tools with a human feel

Whether it's through chat, automation, or embedded insights, clients still want relationships. The tech must enable your team to deliver the human moments that matter most.

Trustworthy intelligence

Clients want smart insights but also want to understand how recommendations are made. Transparency and explainability are essential in a post-AI world.

Why Invessed is built for this future

Invessed isn't a bolt-on product. It's a strategic digital experience layer that connects investment managers with clients.

We don't follow the WealthTech trends. We're already aligned with them:

- Natural language search

- CRM-integrated dashboards

- Saved Scenarios

- API-first architecture

- AI-powered client insights

- Personalised reporting engines

The WealthTech100 confirms what Invessed already believes: client experience is the ultimate differentiator in wealth management.

Wealth is no longer measured in basis points alone. It's measured in trust, engagement, and the quality of every digital touchpoint.