Making the most of client portals for risk profiling and investment advice

Leveraging technology can significantly enhance the client experience and the quality of investment advice. Client portals have emerged as a powerful tool for risk profiling and delivering personalised investment strategies. Here's why integrating a client portal into your firm can make a real difference.

Convenience and accessibility

Client portals offer convenience, allowing clients to access their investment profiles and advice anytime, anywhere. 24/7 accessibility means clients can independently complete risk assessments and review recommendations without needing scheduled meetings.

Personalised investment strategies

Client portals can analyse risk profiles and provide tailored investment recommendations using sophisticated algorithms. This personalised approach ensures that investment strategies align with individual risk tolerances and financial goals. Tailored advice helps craft more effective and suitable investment plans, enhancing the likelihood of achieving desired outcomes.

Enhanced communication

Effective communication is important to a successful advisor-client relationship. Client portals facilitate better communication, allowing clients to share their risk profiles and preferences easily. Advisors can provide timely updates and advice through the portal, ensuring investment strategies align with clients evolving needs. This continuous interaction helps build trust and maintain strong relationships.

"Client portals offer convenience, allowing clients to access their investment profiles and advice anytime, anywhere."

Improved decision-making

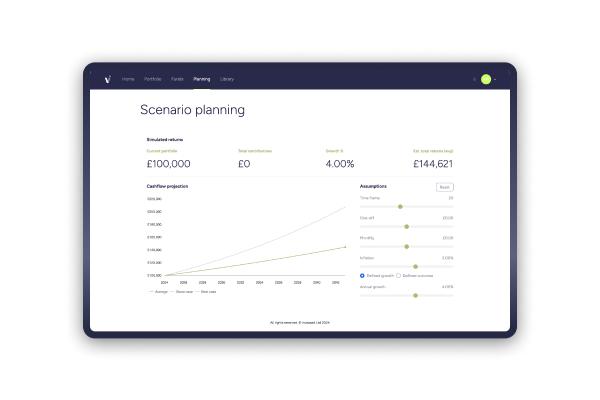

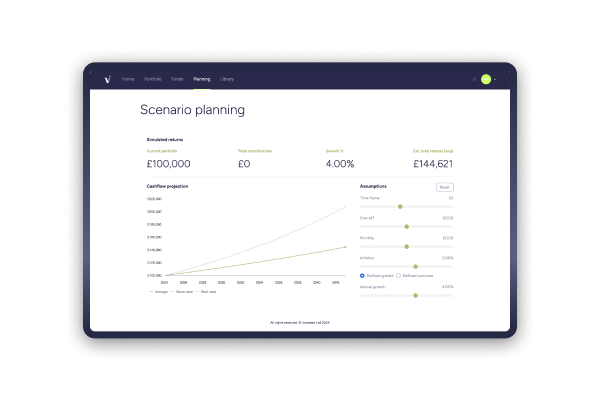

Clients can make more informed decisions with detailed risk profiles and investment analytics at their fingertips. Many client portals include tools that simulate different market scenarios and outcomes based on historical data. This helps clients understand their investment choices and manage their expectations effectively.

Security and transparency

Security is a priority for asset and wealth management firms. Client portals offer transparency by providing insights into investment fees and performance metrics, building confidence and trust in the advisory process.

Scalability for advisors

For financial advisors, client portals offer a scalable solution to manage multiple clients efficiently. Routine tasks such as risk profiling and portfolio rebalancing can be automated, allowing advisors to focus on providing high-value advice and personalised service. This scalability is important for growing advisory practices without compromising on service quality.

Client portals for risk profiling and investment advice streamline the advisory process, making it more accessible, personalised, and secure. They enhance communication, improve decision-making, and provide scalable solutions for advisors. By leveraging these benefits, clients and advisors can achieve better financial outcomes and build stronger, more trusting relationships.

At Invessed, we specialise in delivering client portals to transform risk profiling and investment advice. We understand the challenges advisors face in delivering personalised, efficient services. That's why we've developed a proven approach that leverages cutting-edge technology to streamline your processes and enhance client satisfaction.

Empowering advisors, engaging clients

We design our client portal solutions with your success in mind. We consistently deliver platforms that simplify risk profiling and provide exceptional value for advisors and clients.

24/7 accessibility: Provide round-the-clock access to investment profiles and tailored advice, enhancing client convenience and engagement.

Enhanced communication: Foster stronger relationships through secure, seamless communication channels within the portal.

Scalable solutions: Grow your practice efficiently without compromising on service quality, thanks to our flexible, cloud-native platform.

Personalised client experiences: Leverage advanced risk profiling tools to deliver tailored investment advice, boosting client satisfaction and trust.

Regulatory compliance: Ensure adherence to regulatory requirements, minimising compliance risks.

Real-time insights: Access up-to-the-minute data and analytics for informed decision-making and agile strategy adjustments.

Streamlined processes: Benefit from automated workflows and e-signature capabilities, reducing administrative burdens and saving time.

Behavioural data analysis: Gain deeper insights into client behaviour to refine risk profiles and tailor accurate advice.

With Invessed, you can streamline your risk profiling process, deliver more accurate and personalised investment advice, improve client engagement, and scale your practice efficiently.

Don't let outdated processes hold you back. Contact Invessed to schedule a demo.