The WealthTech100 isn't just a list of standout tech firms. It's a snapshot of where the investment management industry is headed. I've analysed the 2025 cohort to uncover what matters most to CMOs, CTOs, Product Owners, and Heads of IT. More than buzzwords, the trends point to evolving client expectations, leaner operations and the rise of data-driven personalisation. Here's what I found.

1. WealthTech is not one-size-fits-all – and neither are your clients

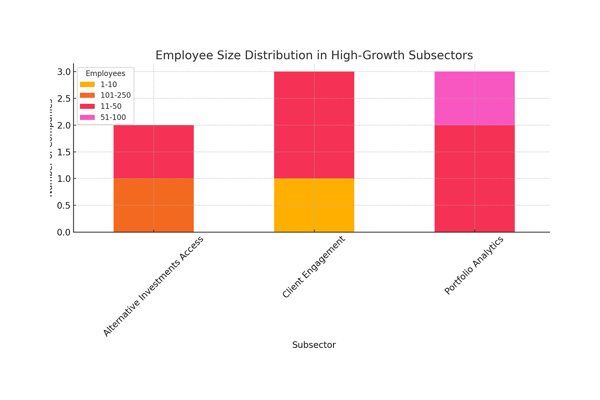

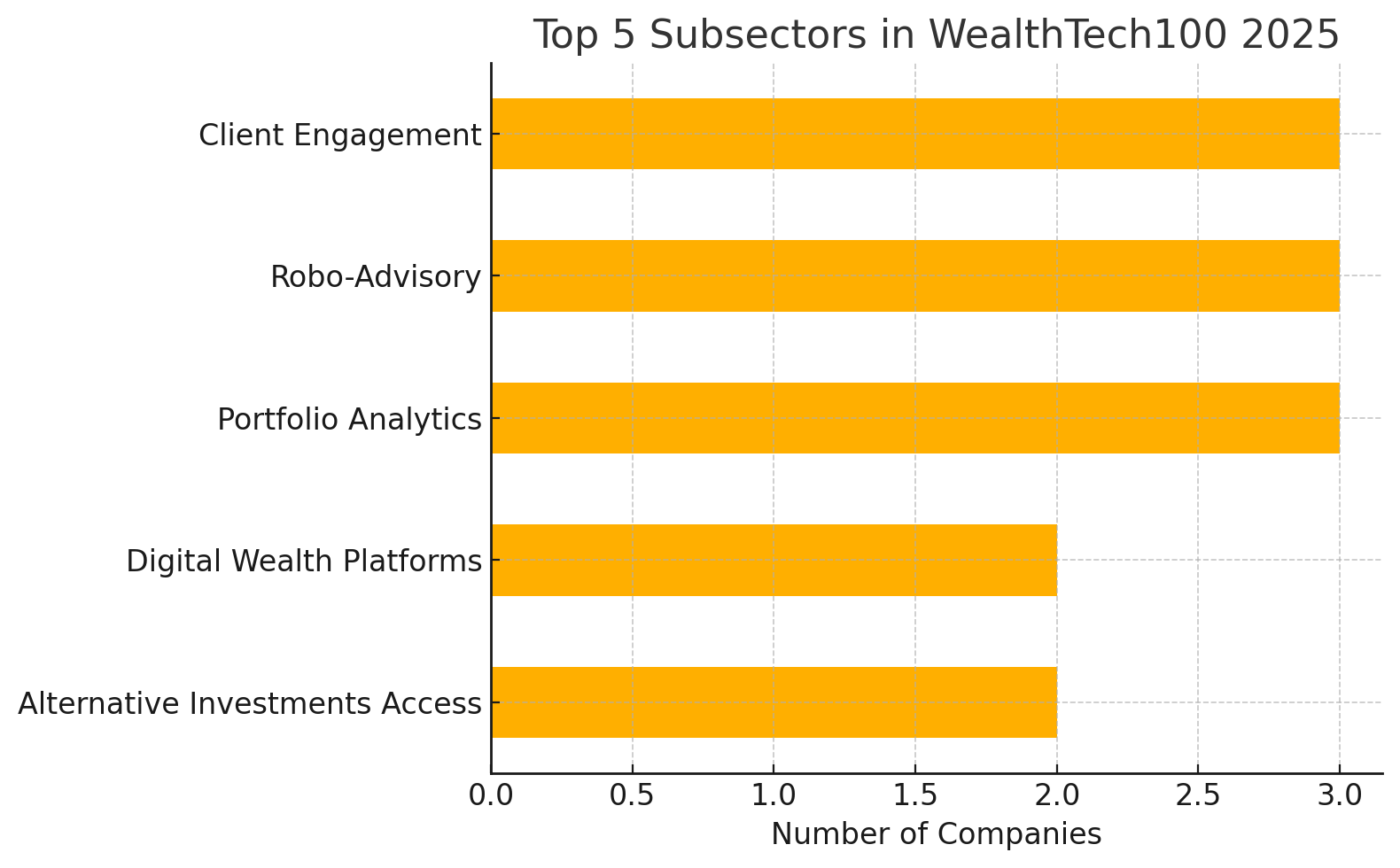

The top subsectors this year reveal a growing specialisation:

- Alternative Investments Access

- Client Engagement Platforms

- Portfolio Analytics

- Robo-Advisory

- Digital Wealth Platforms

This is a reminder for CMOs and Product Owners that differentiation comes from clarity. The most successful firms aren't trying to do everything – they're laser-focused on solving a specific client pain point.

2. B2B is the beating heart of WealthTech

Despite the fintech noise around consumer apps, the real action in WealthTech is behind the scenes. The most frequently served client segments are:

- Wealth Managers

- Financial Advisors

- Institutional Investors

For Heads of IT and CTOs, this validates the case for B2B infrastructure. The demand is not just for new tools, but robust, scalable platforms that enhance advisor productivity and deepen client trust.

3. The modern stack is lean, modular and open

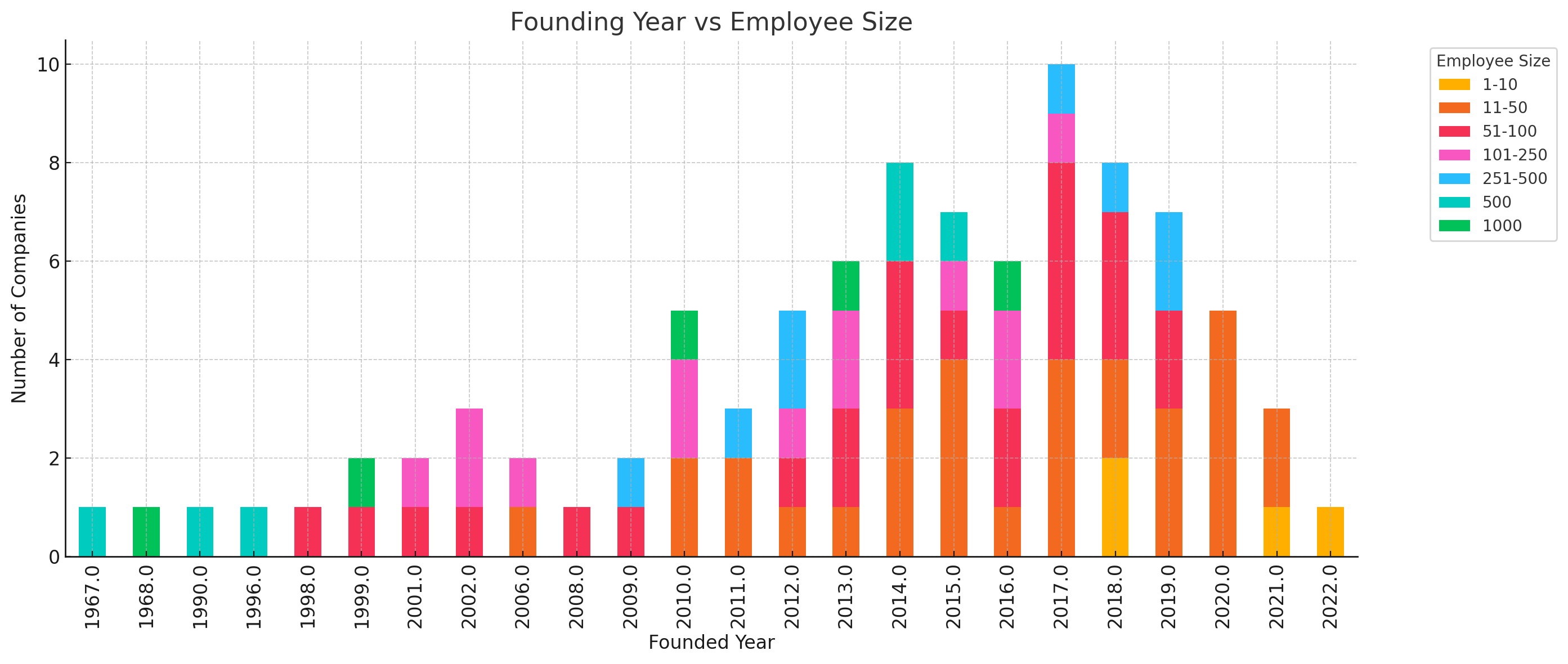

Most WealthTech100 firms are lean (under 250 employees), fast-growing (founded post-2015), and focused on composable services. This can be good news for firms with legacy platforms: transformation doesn't mean a full rip-and-replace.

CTOs and Product Owners should see this as an opportunity to introduce modular solutions that integrate smoothly with existing infrastructure.

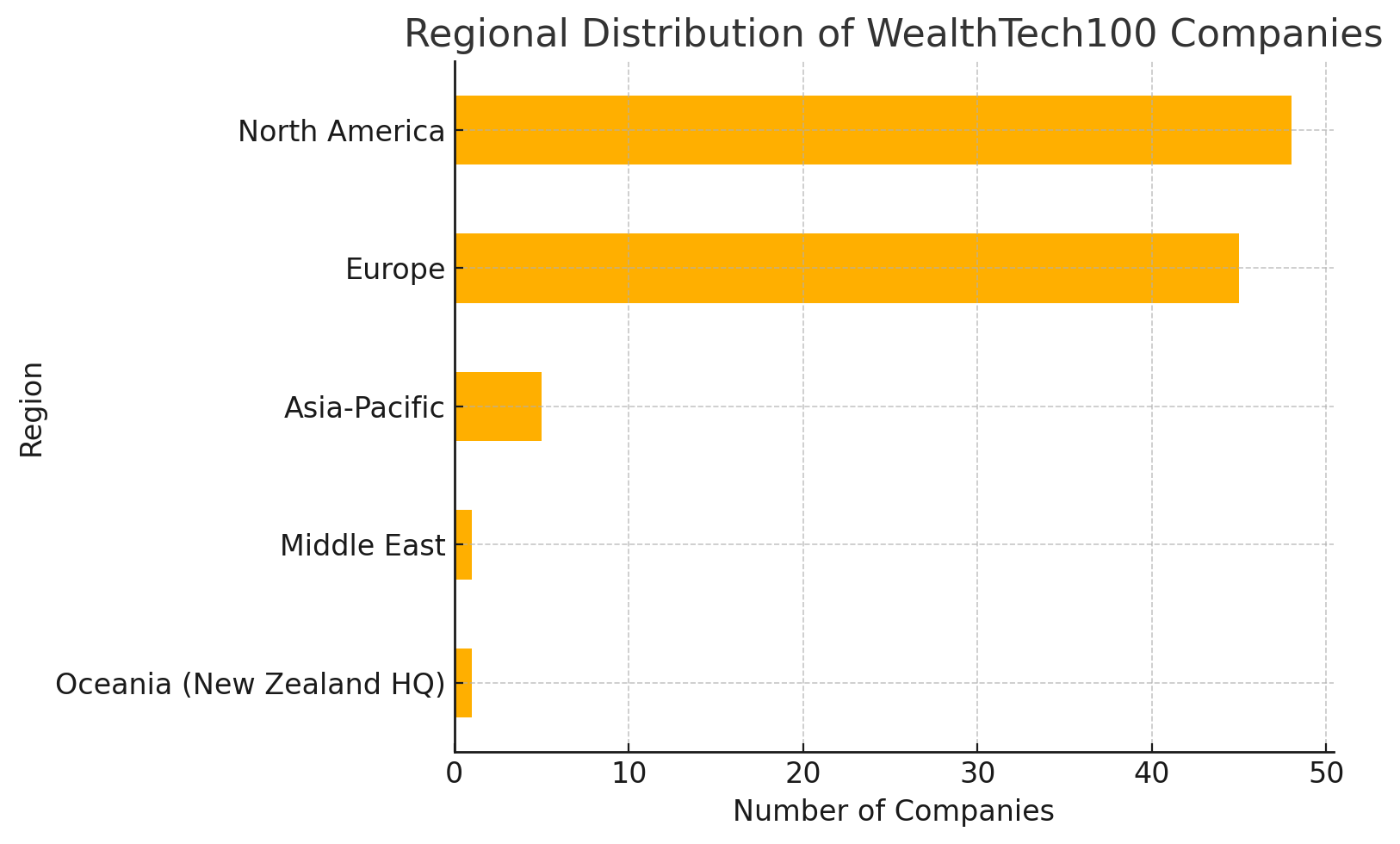

4. Regional leaders are driving global change

North America leads the list, but European and Asia-Pacific challengers are gaining ground. Notably, innovation is being driven by client experience expectations that transcend geography.

For CMOs, the message is clear: global clients expect personalisation, transparency and digital fluency – wherever you are.

Invessed: Built to Scale, Ready to Integrate

Among the companies that are leading this change is Invessed. Our platform blends AI-driven personalisation, powerful data integration and a modular architecture designed for investment firms. Whether you're delivering portals, apps or content platforms, Invessed helps:

- CMOs create experiences that build trust and engagement

- CTOs deploy scalable, secure tech stacks

- Product Owners launch with speed and confidence

- Heads of IT simplify complexity and ensure uptime

We're proud to be part of this movement and ready to help you lead the next phase of digital evolution.

Let's shape what's next.

Talk to us if you're exploring WealthTech partners or rethinking your digital experience strategy. The WealthTech100 tells one part of the story. Let's write the next chapter together.

Contact us or Request a Demo to see how Invessed fits your vision.