The FCA Consumer Duty has significantly impacted the Investment Management and Wealth sector. This requires dedication and innovation from firms to ensure compliance. I'll explore the challenges and discuss how Invessed offers solutions to help wealth management firms achieve Consumer Duty compliance.

Understanding Consumer Duty

Consumer Duty is a regulatory standard. A set of guidelines designed to ensure quality of service in the interest of consumers. All businesses must adhere to a firm requirement in their conduct toward consumers.

This regulatory standard introduces several cross-cutting rules and desired consumer outcomes that firms must adhere to. They ensure a fair and balanced relationship between businesses and consumers.

The first of these rules requires firms to act in the best interests of consumers. Consumers' needs and interests should always come first. Any business practices that do not prioritize consumers are not acceptable.

Secondly, firms must communicate with their clients clearly and fairly. This means they should provide all necessary information clearly and avoid misleading or deceptive communication.

Finally, firms must maintain adequate financial resources. Ensuring they can meet their consumer obligations and continue providing a high-quality service.

91% of wealth management firms have a named person or team responsible for ensuring they meet the requirements of the Consumer Duty.

Monitoring and Assessment of Firm Implementation Progress Survey Findings

What are the Consumer Duty 4 outcomes?

The FCA outlines four key outcomes that firms should strive to achieve to maintain a high standard of service for their consumers:

- Consumers can make effective decisions about financial products and services.

- Consumers receive products and services that are fit for purpose and that perform as firms have led them to expect.

- Firms do not impose post-sale barriers to change products, switch providers, submit a claim, or make a complaint.

- Consumers receive products and services sold in a manner that is fair, clear, and not misleading.

The impact of Consumer Duty on investment and wealth management

Consumer Duty has posed numerous challenges for firms, especially regarding sharing product information, altering fee models, and ensuring consumer understanding. Smaller firms, in particular, are grappling with changes to fee models and managing margin pressures. Moreover, guaranteeing customers' complete understanding of the products and services they invest in has led firms to allocate significant resources for refining communication strategies.

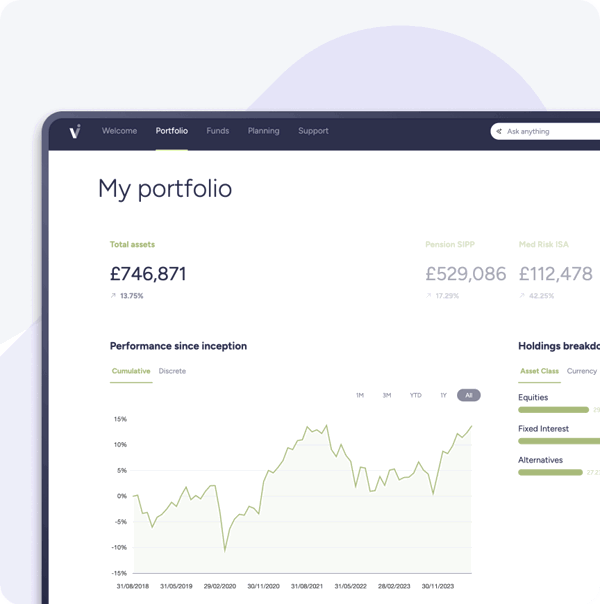

Overcoming Consumer Duty Challenges With Invessed

Invessed offers a variety of solutions to help firms overcome duty requirements. Our unified platform provides a solution for sharing product information, resolving the issue of disparate approaches, and enabling efficient communication. Invessed offers transparent reporting and fee modelling tools, allowing firms to communicate value effectively to their clients.

Only 43% of firms surveyed reported that they are not having difficulty with implementing any aspects of the Duty.

Monitoring and Assessment of Firm Implementation Progress Survey Findings

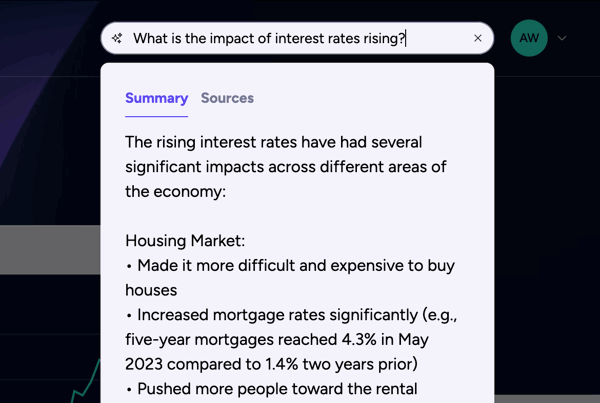

Enhancing Customer Understanding with Invessed

Invessed is a platform that allows Wealth Managers to create customer-centric content that is clear, concise, and engaging. It offers tools for firms to test their communication strategies and gain insights into customer understanding. This helps them to improve their communication efforts.

Embedding a Consumer Duty Culture in Your Firm

A multi-faceted strategy is necessary to integrate a Consumer Duty culture within your firm fully. The following steps outline a comprehensive approach:

- Embedding a Consumer Duty culture within your firm requires a layered approach. This includes:

- Appointing 'Consumer Duty Advocates'.

- Communicating the importance and relevance of Consumer Duty.

- Integrating Consumer Duty principles into the firm's policies.

- Revisiting incentive schemes to align with the Consumer Duty.

Fostering Executive Sponsorship and Governance

Companies can cultivate Executive Sponsorship and Governance by defining roles, involving executives, and fostering accountability. You can achieve this by providing resources, offering training, and introducing a sponsor to the company's leadership.

Clear roles ensure everyone is aware of their contribution to the overall goals. Active executive involvement fosters accountability and encourages open communication at all levels.

Providing resources and training enhances employee skills and proficiency. A sponsor in the leadership team enhances communication between staff and management. They align strategies with company goals and improve employee engagement and morale.

The Future of Consumer Duty in Investment and Wealth Management

Over the next 5 years, Consumer Duty in Investment and Wealth Management will continue to evolve. and become more deeply integrated into the business operations and firm culture.

An increased focus on technological solutions to facilitate compliance, such as advanced data analytics for improved customer journeys and more efficient communication strategies.

Firms will take a universal approach to overlapping initiatives. Ensuring that their efforts in one area do not undermine compliance in another.

In conclusion, introducing FCA Consumer Duty has challenged investment management and wealth firms. They can address challenges with the right tools and strategies. Invessed is perfectly positioned to help firms journey toward compliance, offering solutions that enhance communication, promote transparency, and ultimately improve customer understanding and trust.