As ESG investments gain popularity, what can the industry do to improve transparency and avoid accusations of "greenwashing"?

Environmental, Social and Governance (ESG) investments are gathering pace. In Europe alone, ESG funds grew by almost 60% in 2019 to reach €670Bn. Covid-19 seems to have accelerated the trend, perhaps because concerns over social impact were added to the ones about sustainability.

Strong demand for ESG is linked with the demand for digitalised customer experience, but as the Economist complains of “woolly thinking, marketing guff and bad data”, is the industry truly meeting its responsibilities? I asked Johannes Hauptmann, CEO of Anevis Solutions and James Purcell, Group Head of Sustainable Investing at Quintet Private Bank for their take.

Drivers

To start with, we examined the drivers behind this trend. Customer demand is the obvious starting point according to James: “as ESG topics permeate everyday life, these preferences and ideals are expressed in investment portfolios as well“.

But a spike in demand creates an opportunity to grow assets and retain clients. As the industry sees an opportunity to improve margins, Johannes sees the current growth spurt as “just the beginning, as many brands are currently working on adapting their products”.

Green-washing

The opportunity has certainly created a race to the market, with investors complaining of a lack of consistent data. For both observers, this is more about growing pains than deliberate greenwashing. Citing upcoming EU rules, Johannes notes "once this measurability is fully developed at a high level, we will no longer speak of green-washing."

Transparency and measurability are obviously important, but regulation might not be the best way to get there, especially at an early stage. As James notes, the subject matter may be too raw still to generate consensus, as “personal values play a significant role in how conclusions are formed”.

Reporting

As market pressure builds, ESG reporting standards could emerge rapidly. This could well start as reaping the proverbial 'low hanging fruit'. Johannes would like to see the "many fund managers who invest in sustainability to publish their sustainability reports", and help build awareness. Indeed, Anevis is investing in R&D to help them achieve just that.

From the investment managers’ perspective, the reporting problem goes deeper. “Regulators should focus on ensuring consistency in the information available to fund managers”, says James. If companies can agree on a standard (such as the SASB), then the ESG data will be as accurate as financial data and provide the baseline for meaningful reporting.

Be green, be digital

As concerns about the wider impact of economic activity intensify, ESG investments are set to expand further. Like with other global themes, the impact on the investment management industry will be dramatic, due to customer demand but also regulatory pressures.

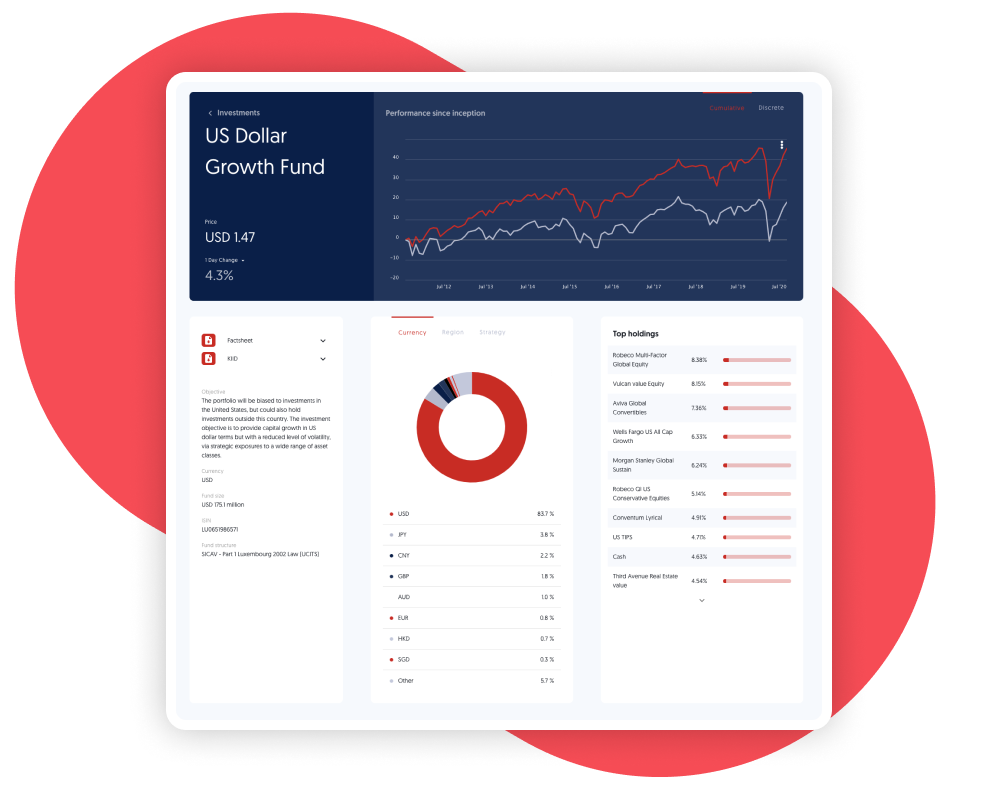

Here at Invessed, we welcome the strong demand for ESG, a trend that goes hand-in-hand with a shift towards a fully digitalized customer experience. Transparency and accountability are at the heart of our efforts. As ESG becomes a permanent fixture in investment reporting, we are ready to do our bit.

👉🏿 You can also read the full interviews