Wealth managers have an abundance of client data. But are they gleaning actionable insight from it?

A leading consultancy recently reminded wealth managers they must fully leverage all the client data that is (or rather should be) at their disposal if they are to meet ever-higher customisation expectations.

The nature of this business means institutions have always been privy to myriad personal data, but the depth and breadth they can seek to harvest, store and use as a real resource has increased exponentially in lock-step with the digitisation of the sector (and life generally).

Institutions have always been privy to personal data, but its depth and breadth has increased exponentially

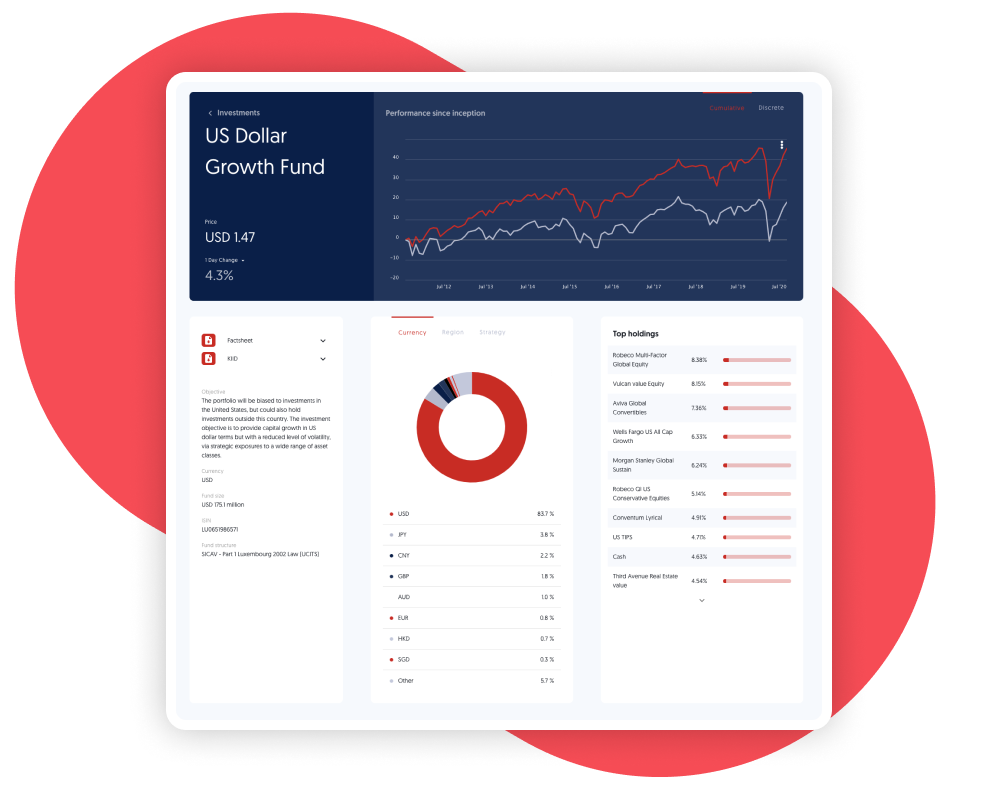

In addition to all the information which emerges in the course of regulatory and relationship management activities, are all the analytics today’s omnichannel communication models generate. How and when clients access their portal to view portfolio information, which content they read, and on what device, along with the advisor communication methods they demonstrably prefer are all easy-win insights today.

Share and share a “Like”

Big tech companies have simultaneously elevated personalisation expectations and cemented a remarkable willingness to share data to this end. In fact, they have built enviably “transportable” loyalty from using profiling to drive high-quality user experiences. Doubters should know that one in three people would consider switching their banking and insurance accounts to Google, Amazon or Facebook if these giants ventured into financial services.

Further, six in ten investors today say they are willing to share information with their wealth advisor from their LinkedIn, Amazon, Facebook and other online accounts. The industry is now started to get excited about this “alternative data” as part of a growing recognition of the massive potential for increasing loyalty – and wallet share – that comes from harvesting everything your clients share about their evolving needs and preferences, in real-time.

Joining the dots

Achieving the fabled “single view of the client” has proven a struggle, however. We see significant variation in CRM maturity in the market and client data often not being centralised into a “master”, with all the inefficiencies, risks and lost opportunities that implies.

CRM data is often not being centralised into a “master”, which implies inefficiencies, risks and lost opportunities

Poorly connected legacy systems and siloed data have created the need for extravagant amounts of “swivel chair integration” as well as posing a significant barrier to further digitisation. Add in reluctance from compliance to move data around yet again, and an element of change fatigue, and it is easy to see why many wealth managers have stalled in their attempts to make the very most of investor information.

Rapid ROI

Actionable insights can actually be generated really rapidly from client data, however, and with very little technology change. Modern modular solutions wrap around legacy systems to efficiently extract and bridge a path between existing data (however archaic) and modern tools like apps. They will also ensure that all marketing and personalisation activities are automatically compliant with GDPR and CCPA, ensuring that making more use of data is always all about the upside.

In data terms, harvest time is certainly upon us. A third of wealth management clients have changed provider or moved assets in the past three years and a further third plan to do so by 2022. Behavioural data has as much potential to identify clients at risk as it has to make investors “stickier” in the first place through concierge-level service delivery, and not to maximise its use seems a crushing waste.

Wealth managers occupy naturally fertile ground and the trust they enjoy means the seeds to deliver top-quality client experiences have already been sown. Competitive and profitability pressures mean they must now start really trying to reap the rewards.