"84% of financial services executives believe that real-time data capabilities are crucial for staying competitive in the market." - Deloitte survey

"62% of investors would consider switching to a different wealth management firm if it offered superior digital capabilities, including real-time portfolio monitoring." - Capgemini study

"As the demand for real-time portfolio monitoring continues to grow, firms must adapt quickly or risk losing clients to more technologically advanced competitors."

"Invessed offers a solution that helps firms give investors what they want: real-time updates and clear information about their money."

Tech-savvy investors demand more from their portfolio management tools. The expectation for real-time monitoring and instant access to financial data has become the norm rather than the exception. This shift presents challenges and opportunities for financial institutions and wealth management firms.

Meeting Heightened Expectations

According to a recent survey by Deloitte, 84% of financial services executives believe that real-time data capabilities are crucial for staying competitive in the market. However, many firms struggle to meet these expectations due to several factors:

- Legacy systems that are not designed for real-time data processing

- Data integration issues across multiple platforms

- Concerns about data security and privacy

- The need for significant infrastructure upgrades

A study by Capgemini found that 62% of investors would consider switching to a different wealth management firm if it offered superior digital capabilities, including real-time investment reporting.

To address these challenges, financial institutions are implementing various solutions:

- Cloud-based platforms: Leveraging cloud technology for scalable, real-time data processing and storage.

- API integrations: Utilising APIs to connect disparate systems and provide a unified view of portfolio data.

- Mobile applications: Developing user-friendly mobile apps that offer instant access to portfolio information.

- AI and machine learning: Implementing advanced analytics for real-time insights and personalised recommendations.

For instance, platforms that integrate with multiple systems provide advisors with a comprehensive view of client portfolios in real time, enhancing their ability to make informed decisions quickly.

How Invessed Can Help

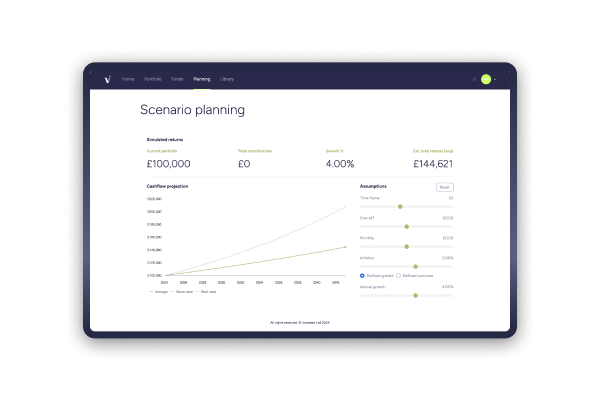

Invessed is at the forefront of addressing the real-time portfolio monitoring challenge. Our platform offers:

- Seamless integration with existing systems, eliminating data silos

- Real-time data processing and visualisation capabilities

- Dashboards for both advisors and clients

- Bank-grade security measures to protect sensitive financial data

- Scalable infrastructure that grows with your business needs

By leveraging Invessed's technology, wealth managers, hedge funds, and family offices can meet and exceed the expectations of tech-savvy clients, providing them with the real-time insights they demand while streamlining operations for advisors.

As the demand for real-time portfolio monitoring continues to grow, firms need to adapt quickly or risk losing clients to more technologically advanced competitors. With solutions like Invessed, firms can transform their client portal into an opportunity to enhance client satisfaction and drive business growth.

In simple terms, as more investors want instant updates on their investments, financial firms need to step up their game. Those who can't provide quick, easy-to-use tools might lose customers to companies that can. Invessed offers a solution that helps firms give investors what they want: real-time updates and transparent information about their money. By using Invessed, advisors can keep their clients happy and grow their business.