Gain better insights and make strategic decisions

Solid data is like gold in the wealth management industry. It provides the edge we need to make smart decisions about client investments. But let's be real: getting good data is not always easy.

It's a two-pronged problem. First, we've got ineffective data management strategies, and then, there's a lack of awareness of the challenges firms face.

90% of the world’s data has been created in the last two years

The amount of data we're dealing with these days is insane, and technologies like AI are adding to the mix. The more data we accumulate, the more costly and complex it becomes.

Scattered data and a lack of completeness stop firms from getting their data in good shape. This is a massive issue for firms as they plan to serve younger generations globally.

Unifying scattered data

For data to be used effectively across all sources, it must be comprehensive.

Data Silos

Data silos are a real pain. They are walls between departments and increase operational costs. Firms must tear down these silos to get a holistic view of their data to maintain consistency, accuracy, and make informed decisions.

Unified Datasets

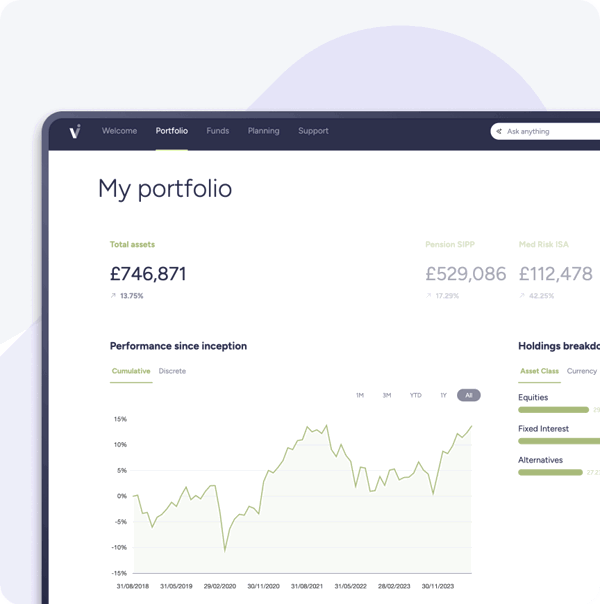

Wealth managers must integrate various sources, such as CRM and third-party market data, to gain a comprehensive 360-degree view. This approach is a one-stop shop, providing access to investment portfolios, market reports, trend analyses, and client financial histories.

Data Sprawl

Data sprawls when firms grow and acquire businesses and technologies; managing that data can be like herding cats. It is then hard to maintain accuracy, consistency, and compliance, limiting our ability to derive insights.

Real-Time Investment Reporting

Regardless of your data location or underlying technologies, unification allows for the easy generation of investment reporting using data and performance metrics. This process is faster and more efficient than manually analysing individual data points.

Hard-working data

Optimising your data is crucial for deriving value. While it can be time-consuming and costly to leverage calculations, analytics, insights, user interfaces, and reports from various data sources, information silos, and large data volumes, the resulting value is unrivaled.

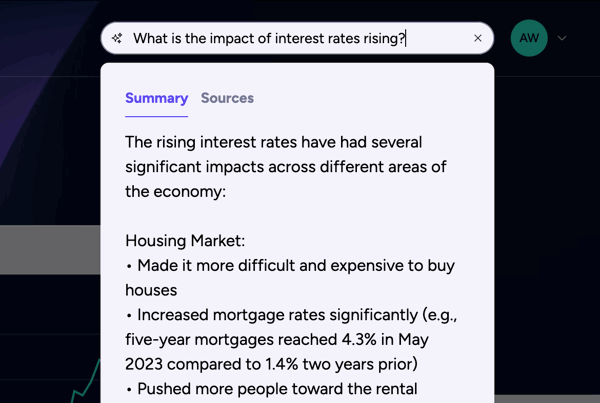

Analytics and Intelligence

Obtaining accurate and timely data for immediate action can be challenging. Consolidating and translating data from diverse sources into a single datasheet can demand significant resources. However, many firms use data management platforms to assist analysts in identifying patterns and trends, thus enabling better-informed decision-making. Despite the challenges, these platforms make identifying patterns and trends much more manageable.

Data Sensitivity

Knowing your data and the need for quick, smooth regulatory actions highlight the importance of strong data governance and compliance. Ensuring strong data governance and compliance is important for your firm's growth.

Key takeaways

Data is investment currency. Leveraging investment data is critical to speed up the decision-making process with your clients.

Address data challenges by enabling wealth and asset managers to use their data, providing tailored, value-driven services to clients.

More than half of wealth management firms continue to use spreadsheets for investment decision-making, a time-consuming and expensive process.

Consolidating data for standardised and customisable insights helps advisors to streamline actionable insights. Clients can then easily understand how these insights shape their wealth management journey.

The next steps for firms tackling their data challenges are to:

- Identifying the efficiencies they aim to achieve

- Evaluating the readiness of their data

- Collaborating with a solutions provider with domain expertise to help audit their current position

The outcome of your data journey is to turn quality data into actionable insights, reducing costs and providing superior financial advice. Complacency towards technology adoption and data analytics should be avoided. Now is the time to take action.