Investment risk tolerance is a hot topic for wealth managers, advisors, and clients. This focus stems from several key factors reshaping the landscape of investment strategy and client relationships.

First, the volatility of global markets demands precise risk assessments to protect investments. Clients now expect investment strategies tailored to their individual risk preferences and financial goals, which requires a deep understanding of risk tolerance.

Furthermore, stricter regulatory frameworks necessitate thorough risk profiling and documentation, reinforcing the importance of risk tolerance assessments. The rise of advanced analytics and AI in financial services also plays a significant role, allowing for more detailed and dynamic risk assessments that enhance decision-making processes.

Lastly, a growing emphasis is on building long-term client relationships through personalised risk management. This approach promotes client retention and satisfaction and fosters trust between advisors and clients.

This article highlights the essential aspects of investment risk tolerance, emphasising its importance in crafting successful investment strategies. Key points discussed include the components of risk tolerance, such as emotional and financial capacity, and the role of wealth managers and advisors in assessing and managing these factors. The article also addresses the challenges faced in accurately gauging risk tolerance and underscores the benefits of aligning investment strategies with clients' risk profiles.

By understanding and leveraging risk tolerance, wealth managers can enhance client satisfaction, improve investment outcomes, and build long-term relationships, ultimately contributing to the firm's growth and differentiation in the market.

The Science Behind Risk Tolerance

Risk tolerance refers to an individual's capacity and readiness to withstand fluctuations in the value of their investments. It is vital for wealth managers and advisors as it helps tailor investment strategies to match clients' comfort levels. Understanding risk tolerance also ensures that investment choices align with the client's financial goals, time horizons, and personal circumstances. This understanding helps mitigate potential losses while maximising the chances of achieving desired investment outcomes.

Investment risk tolerance is not merely a measure of willingness to endure financial loss but a nuanced combination of emotional, economic, and experiential factors. Wealth managers utilise sophisticated methodologies to assess these variables, integrating quantitative and qualitative data to craft personalised investment strategies.

Understanding Investment Risk Tolerance

Investment risk tolerance is the degree to which an individual is willing to endure volatility and potential losses in their investment portfolio. It is crucial in crafting investment strategies that align with personal and financial circumstances.

Understanding risk tolerance is not just about assessing numbers; it's about aligning each client's unique financial journey with their goals and comfort levels.

The components of investment risk tolerance include:

- Emotional Capacity: This refers to an individual's psychological comfort with risk, including their ability to remain calm during market fluctuations.

- Financial Capacity: This is the ability to absorb losses without jeopardising financial security.

- Knowledge and Experience: An individual's understanding of financial markets and investment products influences their risk tolerance levels.

Several factors influence an individual's risk tolerance:

- Financial Goals: Objectives such as retirement, purchasing a home, or funding education can determine the level of risk an individual is willing to take.

- Time Horizon: The duration an individual expects to hold an investment affects their risk tolerance. Longer time horizons typically allow for greater risk-taking, as there is more time to recover from market downturns.

- Personal Preferences: Personal attitudes towards risk, including past experiences and cultural influences, significantly shape risk tolerance.

The Role of Wealth Managers and Advisors

Wealth managers and advisors employ various tools and methodologies to assess and manage clients' risk tolerance. These include:

- Risk Tolerance Questionnaires are structured surveys designed to gauge an individual's comfort level with investment risks. These questionnaires often include questions about financial goals, investment experience, and reactions to hypothetical market scenarios.

- Client Interviews: Personalised discussions that provide deeper insights into a client's financial situation, goals, and psychological attitudes toward risk. This qualitative approach helps advisors tailor investment strategies more effectively.

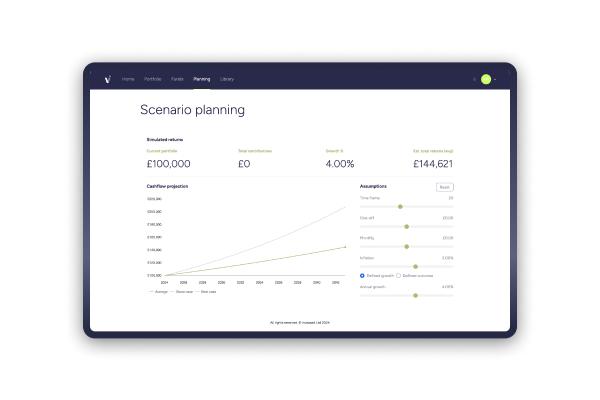

- Financial Planning Software: Advanced tools that analyse a client's financial data and simulate various investment scenarios. These tools help advisors visualise potential outcomes and adjust strategies to align with the client's risk tolerance and objectives.

- Behavioural Analytics: Understanding a client's past investment behavior and decisions can offer valuable insights into their risk tolerance. Advisors use this information to predict future actions and manage risk more effectively.

By utilising these methodologies, wealth managers and advisors can create investment strategies that align with clients' unique risk profiles, ensuring a balanced approach to achieving financial goals.

Balancing Risk and Return

The relationship between risk and return is fundamental in investing. Generally, higher potential returns are associated with higher levels of risk. This means that investors must be willing to tolerate fluctuations and potential losses in their investment portfolio to achieve substantial gains.

Wealth managers and advisors help find the optimal balance between risk and return for their clients. They strive to align investment strategies with clients' financial objectives, ensuring the risk level is appropriate for the desired outcomes. This involves a detailed understanding of the client's risk tolerance, financial goals, and investment time horizons.

To achieve this balance, advisors employ various strategies, such as diversifying portfolios to spread risk, adjusting asset allocations based on market conditions, and continuously monitoring and re-evaluating clients' financial situations. This proactive approach helps in maximising returns while minimising potential risks, thereby supporting clients in achieving their financial objectives.

Case Studies and Examples

These examples highlight the importance of understanding and managing risk tolerance in crafting personalised investment strategies. By aligning investment choices with clients' risk profiles, wealth managers can optimise returns and ensure client satisfaction.

Tailored Portfolio for a Young Professional

A young professional with a high-risk tolerance approached a wealth management firm to create a personalised investment strategy. By understanding the client's long-term financial goals and aggressive risk appetite, the advisor crafted a portfolio heavily weighted in equities and emerging markets, resulting in substantial returns over five years. This personalised approach enabled the client to achieve significant growth while remaining aligned with their risk profile.

Conservative Strategy for a Retiree

An elderly retiree with a low-risk tolerance and a need for a stable income sought advice on managing their retirement fund. The advisor focused on understanding the client's income needs and risk aversion, recommending a conservative portfolio with a mix of bonds, dividend-paying stocks, and other low-volatility assets. This strategy provided steady income while preserving capital, demonstrating the effectiveness of aligning investment strategies with individual risk tolerance.

Balanced Approach for Family Planning for Education

A family planning to fund their children's education requires a balanced investment strategy. By assessing their moderate risk tolerance and time horizon, the advisor created a diversified portfolio that balanced growth and security, incorporating a mix of equities, bonds, and alternative investments. This approach allowed the family to steadily grow their investment while minimising risk and successfully reaching their financial goals for education funding.

Challenges in Risk Tolerance Assessment

Wealth managers and advisors face several challenges when assessing clients' risk tolerance, which can affect the accuracy and effectiveness of investment strategies:

- Subjectivity and Bias: Risk tolerance assessments rely on subjective measures like questionnaires and interviews. These can introduce personal biases from the client and advisor, leading to inaccurate representations of the client's true risk tolerance.

- Emotional Influences: A client's emotional state can influence risk assessment responses. Market volatility or recent financial experiences can skew their risk perception, resulting in assessments that do not accurately reflect their long-term risk tolerance.

- Lack of Standardisation: There is no universal standard for risk tolerance assessments, leading to variations in methodologies and interpretations. This lack of consistency can result in differing assessments for the same client across different advisors or firms.

- Changing Risk Tolerance: A client's risk tolerance is not static and can evolve due to changes in personal circumstances, financial goals, or market conditions. Failing to reassess risk tolerance regularly can lead to misaligned investment strategies.

- Overemphasis on Quantitative Measures: While quantitative tools provide valuable insights, overreliance on them can overlook qualitative factors, such as a client's financial behaviour and preferences, which are crucial for a comprehensive understanding of risk tolerance.

By acknowledging these challenges, wealth managers and advisors can refine their assessment techniques, utilising quantitative and qualitative methods to understand better and align with clients' risk profiles.

How does leveraging risk tolerance contribute to a wealth management firm's growth?

Leveraging risk tolerance effectively can significantly contribute to a wealth management firm's growth in several ways:

- Enhancing Client Satisfaction: By aligning investment strategies with clients' risk tolerance, firms can ensure clients feel comfortable and confident with their investment choices, leading to higher satisfaction and retention rates.

- Attracting New Clients: Demonstrating expertise in personalised risk management can attract potential clients seeking tailored financial advice, expanding the firm's client base.

- Improving Investment Outcomes: Properly assessed risk tolerance enables advisors to construct portfolios that optimise returns while managing risk, leading to better investment outcomes and a stronger track record.

- Building Long-Term Relationships: Consistently reassessing and aligning investment strategies with changing risk tolerances fosters trust and loyalty, resulting in long-term client relationships.

- Differentiating the Firm: Offering sophisticated risk tolerance assessments and personalised investment strategies can differentiate the firm from competitors, enhancing its reputation and market position.

Wealth management firms can effectively leverage risk tolerance to improve service offerings and strengthen their overall business growth and success.

Discover What Invessed Can Do For You

Partnering with Invessed can enhance client satisfaction, improve investment outcomes, and achieve long-term business growth. Contact us today to learn more about our Wealth Engagement Platform.