The financial services sector is in a perpetual cycle of digital transformation. Over the last few years, digitalisation has reshaped how financial companies engage with their clients. So, what's next? For wealth managers, investors, and financial institutions, the future is brimming with opportunities for enhanced client experiences, greater personalisation, and cutting-edge technological integration.

The rise and rise of hyper-personalisation

Is this the year personalised financial services become the norm, not the exception? Gone are the days of one-size-fits-all solutions. Clients now expect highly tailored experiences, and with the rise of AI and machine learning, financial institutions must leverage data to anticipate client needs in real time.

A recent study by Accenture shows that 81% of consumers expect brands to understand their unique needs and expectations. Financial services companies must harness the power of data analytics, predictive models, and client insights to create dynamic, individualised experiences that build loyalty and trust.

Source: Accenture: Financial Consumer Trends

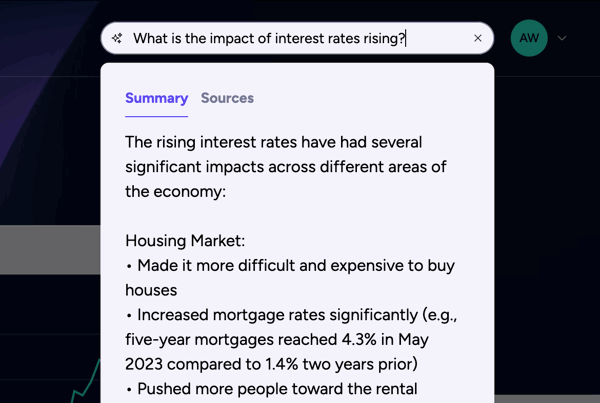

Are AI and automation the backbone of client engagement

AI and automation are poised to revolutionise client interactions. According to Deloitte, 73% of financial services companies are already using AI to enhance customer service, and this trend will continue to grow exponentially. Chatbots, virtual assistants, and AI-powered customer service tools will deliver quicker responses and more accurate advice, reducing friction in client interactions.

By utilising AI to handle routine enquiries and administrative tasks, firms will free up their human agents to focus on complex client needs, creating a more streamlined and responsive service model.

Source: Deloitte: AI in Financial Services

Implementing seamless digital experiences across devices

Mobile-first is now the norm in financial services, as clients have left their desktops behind for more flexible, on-the-go access. Users have already turned to smartphones to manage their finances, highlighting the importance of seamless, responsive, intuitive client engagement apps like Invessed.

A report by PwC highlights that over 60% of consumers prefer conducting their financial transactions through mobile apps. Firms must prioritise developing mobile-friendly platforms that offer intuitive user experiences, from account management to portfolio insights, ensuring clients can access their financial data anytime, anywhere.

Source: PwC: Consumer Preferences in Financial Services

Blockchain and security

For all financial firms, digital security is a top priority. Clients are concerned about the safety of their data. Blockchain technology will significantly enhance data security, offering a more secure way to handle transactions and personal information.

According to IBM, 66% of institutions expect to be in production and running at scale with blockchain. As firms adopt blockchain, they can reassure clients that their data is protected, fostering trust in digital financial services.

Source: IBM: Blockchain in Financial Services

Sustainability and ESG

Sustainability and ESG are key to client engagement. Clients, especially Millennials and Gen Z, are more focused than ever on the ethical practices of the companies they do business with. A recent survey by Morgan Stanley revealed that 95% of Millennials are interested in sustainable investing.

Financial institutions must not only provide clients with ethical investment options but also integrate sustainable practices into their digital offerings. From eco-friendly mobile apps to transparent ESG metrics, aligning with these values will be crucial for financial firms in 2025.

Source: Morgan Stanley: Sustainable Signals

Our conclusion

This year is different. With AI scaling rapidly, companies will struggle to keep pace. To succeed, firms must be bold with their vision, relentlessly innovate, and have an unwavering commitment to the client experience.

At Invessed, we help you stay close to your clients. Our Client Engagement Platform delivers websites, client portals, and apps for investment managers and financial firms.

Ask Invessed about AI Search for your website, app or client portal or how ChatGPT and Gemini recommend or discuss your product or brand with customers.