The Wealth Management Industry is Undergoing a Significant Transformation

In the past year, technology has had a profound impact on the wealth management industry. It has driven innovation and transformed the delivery of services. We have witnessed the increased use of Artificial Intelligence (AI) to automate investment recommendations, portfolio management, and risk assessment. There has also been rapid growth in real-time mobile apps, enabling clients to conveniently access their accounts and track investments on the go. Furthermore, wealth management platforms are leveraging big data analytics to gain valuable insights into client behaviour and preferences.

Technology has played a vital role in driving innovation, improving efficiency, and enhancing the client experience in wealth management. Wealth managers are embracing advanced technologies to provide personalised and data-driven services, empower clients with real-time information, and ensure the security and transparency of transactions.

As technology continues to evolve, advanced technologies are rapidly revolutionising investment recommendations, portfolio management, and client engagement. Traditional approaches are being replaced by these innovations. Wealth managers have the opportunity to embrace innovation, adapt quickly, and stay ahead of the competition by exploring key technological advancements that are reshaping the sector.

Wealth managers can effectively utilise new and emerging technologies to drive innovation at a rapid pace and on a large scale.

To seize growth opportunities, wealth managers should focus on leveraging technological advancements to enhance operations. By having clear strategies for transformation and growth, wealth managers can effectively utilise new and emerging technologies to drive innovation at a rapid pace and on a large scale. Wealth leaders must adapt swiftly to maintain their competitive edge.

1. Artificial Intelligence Algorithms for Automated Investment Recommendations

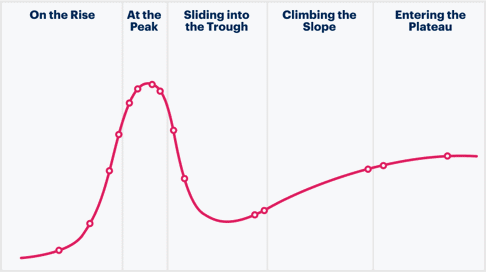

As generative artificial intelligence hits the 'Peak of Inflated Expectations' on the Gartner Hype Cycle, wealth management platforms begin to utilise algorithms to automate investment recommendations. By analysing vast amounts of data and considering factors such as risk tolerance, investment goals, and market trends, AI algorithms can offer personalised and data-driven investment advice.

By analysing vast amounts of data and considering factors such as risk tolerance, investment goals, and market trends, AI algorithms can offer personalised and data-driven investment advice.

The three primary applications for AI in wealth management platforms are:

- Automated Investment Recommendations: AI algorithms analyse data, including risk tolerance and market trends, to provide personalised and data-driven investment advice.

- Portfolio Management: AI algorithms can automate portfolio management by continuously monitoring and adjusting investments based on market conditions and individual goals.

- Risk Assessment and Management: AI technologies can assess and manage risks by analysing large amounts of data, identifying patterns, and providing strategies for risk mitigation.

2. Real-Time Mobile Apps for Enhanced Client Experience

Mobile apps have become an integral part of wealth management, allowing clients to access their accounts and track investments in real time. These apps provide convenience and empower clients with instant access to their financial information, enabling them to make informed decisions on the go.

Mobile apps have become an integral part of wealth management, allowing clients to access their accounts and track investments in real-time.

Cutting Edge wealth management platforms like Invessed empower clients in several ways:

- Access to Comprehensive Financial Information: Clients can have a centralised system that stores all their financial data, including investment portfolios, transaction history, and account statements. This allows them to have a holistic view of their financial situation and make informed decisions.

- Real-Time Monitoring and Tracking: Clients can access their wealth management accounts through mobile apps or online client portals, enabling them to track their investments and monitor their portfolio performance in real time. This provides convenience and transparency.

- Personalised Investment Recommendations: Wealth management platforms utilise advanced technologies, such as artificial intelligence and machine learning, to analyse client data and provide personalised investment recommendations. Clients can receive tailored advice based on their financial goals, risk tolerance, and investment preferences.

- Enhanced Communication and Engagement: Clients can communicate with their wealth managers or advisors through secure messaging systems or online portals. This enables them to ask questions, seek clarification, and receive timely updates on their investment strategies.

- Educational Resources and Tools: Wealth management platforms often provide educational resources, such as articles, videos, and financial calculators, to help clients improve their financial literacy and make informed investment decisions. These tools empower clients to take an active role in managing their wealth.

- Enhanced Security and Privacy: Wealth management platforms prioritize the security and privacy of client information. They employ robust security measures, such as encryption and multi-factor authentication, to protect client data and ensure confidentiality.

- Streamlined Workflow and Efficiency: These platforms automate various administrative tasks, such as client onboarding, document management, and account maintenance. By eliminating manual processes, advisors can focus more on client interactions and strategic decision-making, increasing their productivity and efficiency.

- Data-Driven Insights and Analytics: Wealth management platforms leverage data analytics to provide advisors with valuable insights into client behavior, investment performance, and market trends. By analysing this data, advisors can make informed decisions, adjust investment strategies, and offer personalised recommendations to their clients.

- Enhanced Client Engagement: Wealth management platforms enable advisors to engage with their clients through various channels, including mobile apps, online portals, and secure messaging systems. This allows advisors to provide timely updates, respond to client inquiries, and deliver personalised advice, enhancing the overall client experience.

By leveraging the capabilities of wealth management platforms like Invessed, advisors can streamline their operations, gain valuable insights, collaborate with peers, and ultimately deliver better outcomes for their clients.

3. Blockchain Technology for Transparent and Secure Transactions

Blockchain technology is revolutionising the financial industry by ensuring transparent and secure transactions. By implementing blockchain in wealth management platforms, users can have full visibility into their transactions, reducing the risk of fraud and enhancing trust among clients.

By implementing blockchain in wealth management platforms, users can have full visibility into their transactions, reducing the rise of fraud and enhancing trust among clients.

Blockchain technology reduces the risk of fraud in wealth management platforms through its inherent characteristics of transparency, immutability, and decentralisation.

Transparency: Blockchain provides a transparent and tamper-proof ledger where all transactions are recorded in a decentralised manner. Each transaction is verified by multiple network participants and becomes a permanent record that cannot be changed without network consensus. This transparency allows authorised participants to view all transactions, making it difficult for fraud to be unnoticed.

Immutability: Transactions recorded on the blockchain are permanently stored in the ledger. The data is secured and linked to previous transactions, creating an unchangeable chain of blocks. This prevents fraud and data manipulation.

Decentralisation: Blockchain operates on a network of computers called nodes that validate and maintain the blockchain. This distributed network eliminates the need for a central authority, reducing the risk of vulnerabilities. It is difficult for fraudsters to manipulate or control the blockchain because they would need to compromise a majority of the network's computing power, which is highly impractical.

By using blockchain technology, wealth management platforms can create a secure and transparent system. All transactions are recorded and verified by multiple participants, reducing the risk of fraud. Clients can trust that their transactions are secure and cannot be tampered with, building trust in the platform and the wealth management process.

5. Machine Learning for Personalised Investment Strategies

Machine learning is a powerful tool that drives innovation, improves efficiency, and enhances the client experience in the wealth management industry. Wealth management platforms are integrating algorithms to analyse market trends and offer personalised investment strategies. By considering individual preferences, risk profiles, and market conditions, machine learning algorithms provide tailored investment recommendations to clients.

Furthermore, machine learning provides valuable insights into market trends and client behaviour, helping wealth managers stay ahead of the competition and deliver superior outcomes for their clients.

6. Biometric Authentication for Enhanced Platform Security

To enhance the security of wealth management platforms, biometric authentication methods such as fingerprint or facial recognition are being introduced. These advanced authentication techniques provide an extra layer of security, ensuring that only authorised individuals can access sensitive financial information.

7. Big Data Analytics for Personalised Insights

With the abundance of data available, wealth management platforms are leveraging big data analytics to gain valuable insights into client behaviour and preferences. By analysing this data, platforms can offer personalised investment recommendations and tailor their services to meet individual client needs.

Using big data analytics in wealth management platforms offers several benefits for meeting wealth managers' client needs:

- Personalised Investment Recommendations: Big data analytics allows wealth managers to analyse vast amounts of client data, including financial behaviour, investment preferences, and risk profiles. By leveraging this data, wealth managers can provide personalised investment recommendations tailored to each client's individual needs and goals.

- Improved Decision-Making: Big data analytics provides wealth managers with valuable insights into client behaviour, market trends, and investment performance. By analysing this data, wealth managers can make more informed decisions regarding investment strategies, asset allocation, and portfolio management.

- Enhanced Risk Management: Big data analytics enables wealth managers to identify and mitigate potential risks. By analysing historical data and market trends, wealth managers can detect patterns and anticipate risks, allowing them to develop strategies to minimise potential losses and protect client investments.

- Client Segmentation: Big data analytics allows wealth managers to segment their client base based on various factors such as age, income, risk tolerance, and investment goals. By understanding the different segments, wealth managers can tailor their services and communication strategies to better meet the specific needs and preferences of each segment.

- Improved Client Engagement: Big data analytics helps wealth managers gain a deeper understanding of their clients' needs, preferences, and behaviors. With this knowledge, wealth managers can engage with their clients more effectively, providing personalised advice, relevant investment opportunities, and timely updates that resonate with each client.

- Enhanced Client Satisfaction: By leveraging big data analytics, wealth managers can provide a more personalised and tailored experience for their clients. This leads to increased client satisfaction as clients feel understood, valued, and supported in achieving their financial goals.

Overall, utilising big data analytics in wealth management platforms allows wealth managers to better understand their clients, provide personalised services, make data-driven decisions, and effectively manage risks. This ultimately leads to improved client outcomes, increased client satisfaction, and a competitive edge in the wealth management industry.

8. Chatbot Technology for Instant Customer Support

Chatbot technology like Azure’s AI Bot Service is revolutionising customer support in wealth management platforms. By leveraging natural language processing and AI, chatbots can provide instant and accurate responses to common queries, improving customer satisfaction and reducing response times.

Chatbot technology offers wealth managers various benefits, including instant customer support and improved response times. Here are a few examples of how chatbot technology can be utilised in wealth management platforms:

- Automated Customer Assistance: Chatbots can assist clients in answering frequently asked questions, and providing instant responses to inquiries regarding account balances, transaction history, or general information about investment products and services.

- Risk Assessment and Profile Creation: Chatbots can interact with clients to gather information about their financial goals, risk tolerance, and investment preferences. Based on the collected data, chatbots can generate personalised risk profiles and recommend suitable investment strategies.

- Investment Recommendations: Chatbots equipped with artificial intelligence algorithms can analyse market trends, client data, and investment goals to provide personalised investment recommendations. Clients can receive real-time advice on portfolio diversification, asset allocation, and investment opportunities.

- Educational Resources: Chatbots can offer educational resources such as articles, videos, and interactive tools to help clients enhance their financial literacy. They can provide insights into investment concepts, explain financial terminology, and offer guidance on investment strategies.

- Transaction Support: Chatbots can assist clients in executing transactions, whether it's buying and selling stocks, transferring funds, or making investment adjustments. Clients can receive guidance and support in completing transactions accurately and efficiently.

9. Robo-Advisors for Automated Investment Advisory Services

Robo-advisors like moneyfarm are automated investment platforms that utilise algorithms to provide low-cost and automated investment advisory services. By leveraging technology, robo-advisors make investment recommendations based on predefined criteria, enabling clients to access professional investment advice at a fraction of the cost.

Robo-advisors are increasingly being used in the wealth management sector due to their numerous advantages and their impact on the industry. Here are some reasons why many individuals and firms are turning to robo-advisors:

- Cost-Effectiveness: Robo-advisors offer automated investment advisory services at a fraction of the cost compared to traditional human advisors. They typically have lower fees and minimum investment requirements, making them accessible to a wider range of investors.

- Accessibility: Robo-advisors provide a convenient and user-friendly platform for investors to access professional investment advice. They are available 24/7, allowing clients to manage their investments at their convenience, without the need for in-person meetings.

- Efficiency: Robo-advisors leverage advanced algorithms and technology to automate investment processes. This results in faster execution, efficient portfolio management, and streamlined administrative tasks. Investors can benefit from real-time portfolio monitoring and automatic rebalancing, ensuring their investments align with their goals.

- Personalisation: Despite being automated, robo-advisors can provide personalised investment strategies based on individual goals, risk tolerance, and time horizon. These platforms utilise algorithms to analyse client data and preferences, tailoring investment recommendations accordingly.

- Transparency: Robo-advisors offer transparent investment solutions, providing clients with clear visibility into their portfolios, fees, and investment strategies. Investors can easily track their investments, understand the rationale behind recommendations, and have access to comprehensive reporting.

- Data-Driven Insights: Robo-advisors leverage data analytics and machine learning to analyse market trends and client behavior. By analysing vast amounts of data, these platforms can offer valuable insights that inform investment strategies and optimise portfolio performance.

The impact of robo-advisors on the wealth management sector is significant. They have brought about several changes and benefits:

- Expanded Market Reach: Robo-advisors have democratised access to professional investment advice. Investors who were previously underserved or unable to meet the high minimum requirements of traditional advisors can now participate in wealth management services.

- Improved Efficiency: The automation of investment processes reduces manual tasks and administrative burdens for wealth management firms. This allows advisors to focus more on strategic decision-making, client engagement, and delivering personalised service.

- Enhanced Client Experience: Robo-advisors provide a seamless and user-friendly experience to clients, offering convenience and accessibility. They enable clients to have greater control over their investments and access personalized advice without the need for face-to-face meetings.

- Increased Competition: The rise of robo-advisors has intensified competition within the wealth management sector. Traditional advisors are adopting digital solutions and incorporating robo-advisory features to remain competitive and attract tech-savvy clients.

- Hybrid Models: Many wealth management firms have embraced a hybrid model, combining the benefits of robo-advisory services with human advisors. This allows clients to have access to both automated and personalised advice, catering to different preferences and needs.

- Emphasis on Technology: The emergence of robo-advisors has prompted wealth management firms to invest in technology and digital infrastructure. This has led to advancements in areas such as cybersecurity, data analytics, and client-facing platforms, ultimately benefiting clients across the industry.

Robo-advisors have revolutionised the wealth management sector by providing cost-effective, accessible, and personalized investment advisory services. Their impact is evident in the increased efficiency, expanded market reach, and enhanced client experience within the industry.

10. Social Media-Like Platforms for Collaboration and Knowledge-Sharing

To foster collaboration and knowledge-sharing among clients and advisors, wealth management platforms are incorporating social media-like features. These platforms enable users to connect, share insights, and exchange ideas, creating a vibrant community that enhances the overall wealth management experience.

Wealth management platforms incorporate social or community features to foster collaboration and knowledge-sharing among clients and their advisors. Here are a few examples:

- Social Feeds: Wealth management platforms are incorporating social feeds similar to social media platforms. Clients and advisors can post updates, share articles or resources, and interact with each other by liking, commenting, or sharing content. This feature facilitates communication and engagement within the platform's community.

- Expert Q&A: Some platforms offer a feature where clients can ask questions directly to experts or advisors within the community. This allows users to seek advice, clarify doubts, and receive guidance from professionals with specialised knowledge.

- Webinars and Virtual Events: Wealth management platforms organise webinars and virtual events where clients and advisors can participate and learn from industry experts. These events provide opportunities for users to expand their knowledge, gain insights, and connect with like-minded individuals.

These are just a few examples of how wealth management platforms are incorporating social or community features to create an interactive and collaborative environment for their users.

Unlock new possibilities, drive innovation, and create a brighter future for the industry as a whole

It is clear that technology is reshaping the wealth management landscape, and those who embrace these advancements will be well-positioned to thrive in the industry. As wealth managers continue to adapt to the evolving needs and expectations of clients, the integration of innovative technologies will play a crucial role in driving innovation, growth, and success.

Wealth managers must seize the opportunities presented by technology to stay ahead of the competition and provide exceptional value to their clients. By leveraging the power of technology, wealth managers can navigate the complexities of the modern financial landscape, deliver personalised and data-driven solutions, and empower their clients to achieve their financial goals.

The future of wealth management lies in the effective utilisation of technology to deliver personalised, transparent, and efficient services that meet the evolving needs of clients. By embracing these technological advancements, wealth managers can unlock new possibilities, drive innovation, and create a brighter future for the industry as a whole.