There are a wide range of opinions on the future of cryptocurrency - but it’s only getting bigger and is increasingly hard to ignore.

Key points

- Cryptocurrencies are highly volatile - even considered dangerous

- Asset managers tend to shy away from such speculative asset classes

- Yet tech-savvy professional investors are making crypto increasingly relevant

- Even at the current risk level, it may hold useful lessons and opportunities

- The key is transparent reporting and frank engagement with investors

What happens when you poke a stick at cryptocurrency?

Even as Goldman Sachs looks to expand its offerings in cryptocurrency beyond bitcoin, regulators and many big banks remain wary. Bank of England Governor Andrew Bailey cautions on the use of cryptocurrencies for payment: "If you want to buy them then please understand that you can lose, you could lose all your money”. A tweet from Elon Musk recently catapulted dogecoin and bitcoin all over the place and, in studying the latter’s value over time, its unpredictability is evident.

Many assetmanagers are sceptical

As noted by Jason Pride, of Glenmede: “The volatility of cryptography is stratospherically high and we often see that when stocks sell, so does bitcoin, which means it’s not a good diversifying portfolio”. The CIO of Amundi, Europe's second largest asset manager, recently called bitcoin a farce, saying that regulators and governments would ultimately "stop the music” with cryptocurrencies.

Cautious steps and lots to learn

Many professional investors and asset managers are finding cryptocurrencies, whose market capitalisation had reached almost $400 billion by 2020, impossible to ignore and are seeking to incorporate at least some crypto into their portfolio spreads.

Meanwhile retail investors are finding it hard to distinguish between the many variants of cryptocurrencies as well as understanding the trading process, which feels esoteric - but an increasing number of digital crypto asset management platforms are helping to make cryptocurrencies more accessible.

Risk aside, could crypto hold useful lessons and opportunities?

In May 2021, a sell-off fuelled by regulatory uncertainty wiped out a big chunk of the market cap, but proponents of cryptocurrency remain bullish, for example around ether, which experienced a smaller drop than bitcoin. Some asset managers may see crypto as a way to counter the ongoing downward pressure on fees, by opening up a new client base and revenue source. If the USA’s Securities and Exchange Commission approves an ETF that can buy bitcoin in the U.S., a cryptocurrency boom may ensue.

The key is transparency and frank engagement with clients

Gene Hoffman, president and COO of Chia, has compared crypto’s volatility to the 1990s’ volatility in Internet stocks - and many bold early investors in those stocks reaped significant rewards. At the same time, cautionary tales came out of that era, including the rise and fall of properties like boo.com.

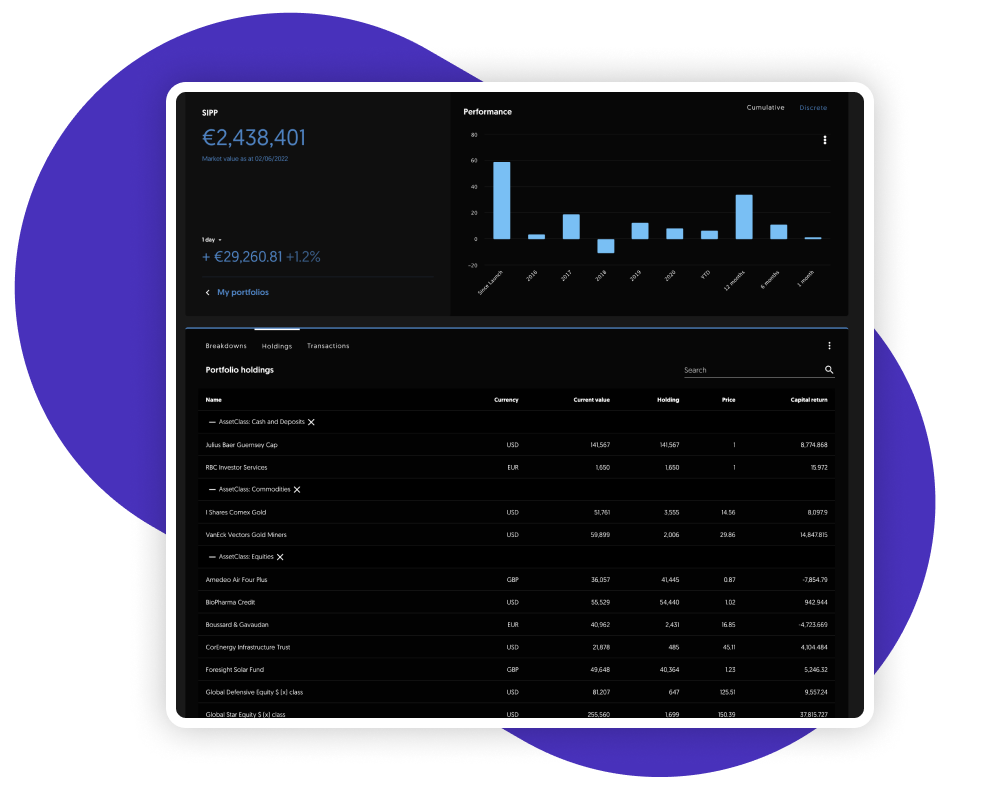

Asset managers adding cryptocurrencies to their spread will want to be frank and open in crypto discussions with their investors, sharing both knowns and unknowns - and provide them with transparent and detailed reporting on cryptocurrency fluctuations. The Client Portals we build for clients provide a way to interactively and intuitively showcase traditional portfolios’ performance and can do exactly the same for cryptocurrencies. Ask us for more details.