Locate, Protect, Collect, Enrich, Exploit. Optimise your data strategy with our 5-step approach

What's your data strategy? In a classic HBR article, the authors drive a distinction between data used for Defensive and Offense data; between data needed to power operations versus improving competitive position; between control and flexibility.

For Asset and Wealth Managers, compliance and operations have long dictated Defensive data strategy but Offense data has been underdeveloped. In our perspective, a new metric is needed to measure a firm's success in collecting this data: Data under Management (DuM).

Since I last posted on this subject, a number of queries have a come up about how to practically approach a DuM project. Typically, the approach involves these 5 steps:

1. Locate data sources

In financial services data is literally everywhere, including financial systems; Cloud applications like CRMs and CMSs; internal systems and communications - to name but a few. Make a list of all sources, making sure to capture:

- Who owns the data? Who has permission to access and change it?

- What is the ontology, i.e. the categories, properties and links between entities?

- Are there ways to interrogate and put it to use?

2. Install appropriate governance

As soon as you have a list of your data sources, you must ensure ownership and access are aligned. Regulation like GDPR and CCPA will apply here, but so does common sense: financial services is a business of trust. Consider the following:

- Has the owner granted permission to use the data?

- Is access restricted to those with the relevant permissions?

- Are there appropriate controls and monitors in place?

3. Collect, organise and measure

By now, you have a list of data sources that you can use. Next, you must install the integration mechanisms to collect your data, structure it in a meaningful way and measure its volume and growth velocity. To start with, consider:

- What is the optimal way to capture, transform and store data?

- Can we leverage the Cloud to keep costs in check?

- What is our total Data under Management, and how will it grow?

4. Enrich and create context

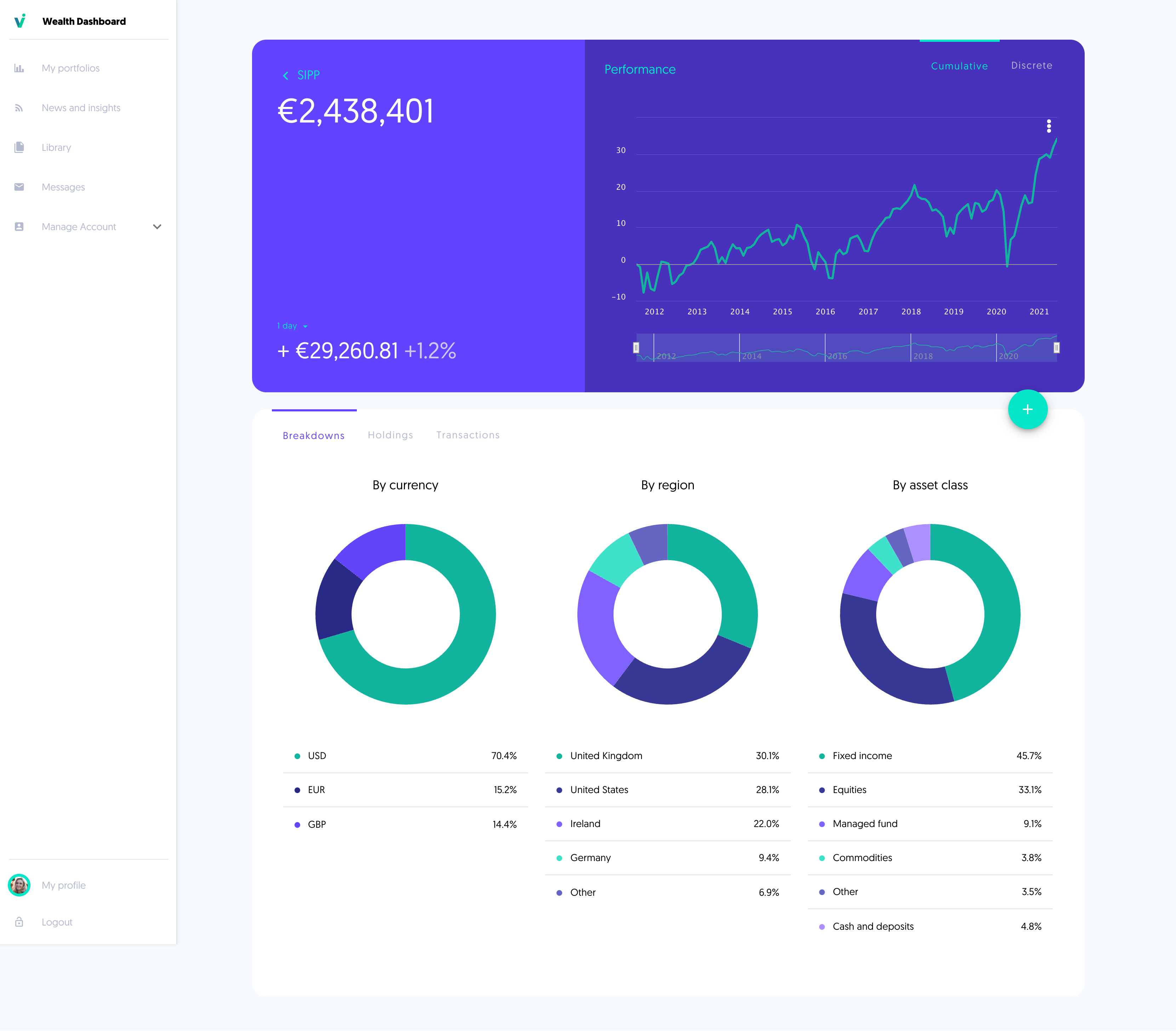

Uniquely, data is able to augment its own value through enrichment and correlations with other data sets. Through combinations and visualisations, you create context and convert information into insights. For example:

- How do different sets (e.g. portfolio performance v portal traffic) hang together?

- Do patterns emerge as data changes with time or between customers?

- What other data can I collect to introduce meaningful relationships?

5. Extract value

So far we have identified, protected, collected and enriched our data. The final step is the most important one - putting the data to use to generate value for your company. Put another way, in these activities your DuM will impact your AuM:

- Can we increase customer loyalty through service personalisation?

- Are there insights to make risk management more effective?

- With deeper insights, can we improve resource allocation and manage costs?

Data under Management is our way of challenging AuM's dominance as a success measure for Asset and Wealth Managers.

Conclusion

Data is everywhere - and everything is data. Data under Management is our way of challenging AuM's dominance as a success measure for Asset and Wealth Managers. To be effective, data needs to be sourced, governed, organised, enriched - and then put to work in order to deliver measurable value.

We have created a platform to help you implement a data strategy, and an agile methodology to take you through the journey.

If this sounds interesting for your organisation, get in touch.