Connect to legacy systems through secure APIs while preserving your existing operations.

Protect client data with bank-level security, encryption, and multi-factor authentication.

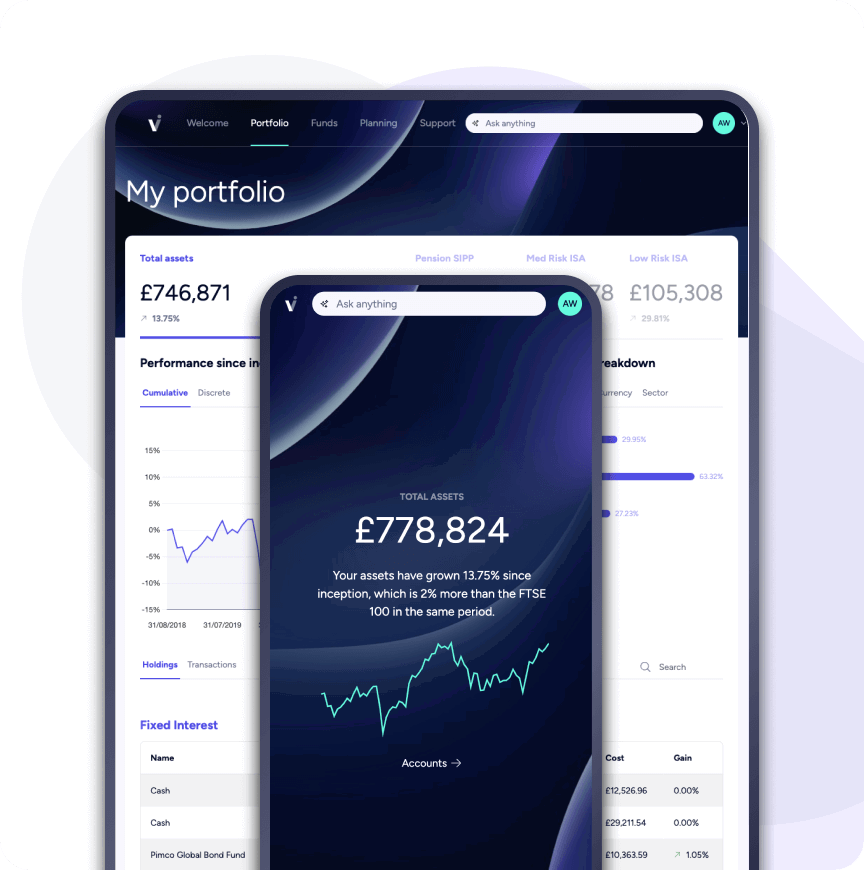

Deliver a tailored digital solution to satisfy both tech-savvy and traditional clients.

Rapidly deploy new features to compete with FinTech offerings using our modern tech stack.

Modernise your platforms with seamless integration, compliance and security

Private banks face unique challenges, including regulatory compliance across jurisdictions, integration with legacy systems, maintaining bank-level security, and balancing traditional service with modern technology needs.

We address these challenges through scalable, secure digital banking solutions seamlessly integrated with existing infrastructure. We leverage enterprise-grade security protocols and modern cloud platforms like Azure to deliver an enhanced, compliant user experience while accelerating projects through agile development practices.

Comprehensive features for private banks

Wealth overview, bespoke dashboards and interactive investment tools

360° client view, real-time analytics and CMS integration

Automated compliance checks, bank-grade security and regulatory compliance

Digital onboarding, client self-service and custom forms & approvals

Multi-source data integration, CRM integration and audit trails

Document management and data security

Client engagement tools, multi-language & currency and lead capture forms

The CX revolution is underway. Attitudes have shifted from "we want this" to "we need this".

Theo Paraskevopoulos, Invessed CEO