Can we engage the next generation of investors?

Challenge

The intergenerational wealth transfer is well underway, with the younger generations estimated to inherit $30 over the next couple of decades. Moreover, investors are not only younger, but also both diverse in terms of gender and background.

The new class of investors demand different level of customer service. They are less loyal, more likely to question fees, more sensitive to the environmental impact of their investments, and consider digital servicing a given.

What are the pain-points?

Analysis

Modernise CX

Ensure seamless client service on web and mobile across the client lifecycle, with additional toolkit to enhance customer-advisor interactions.

Streamline reporting

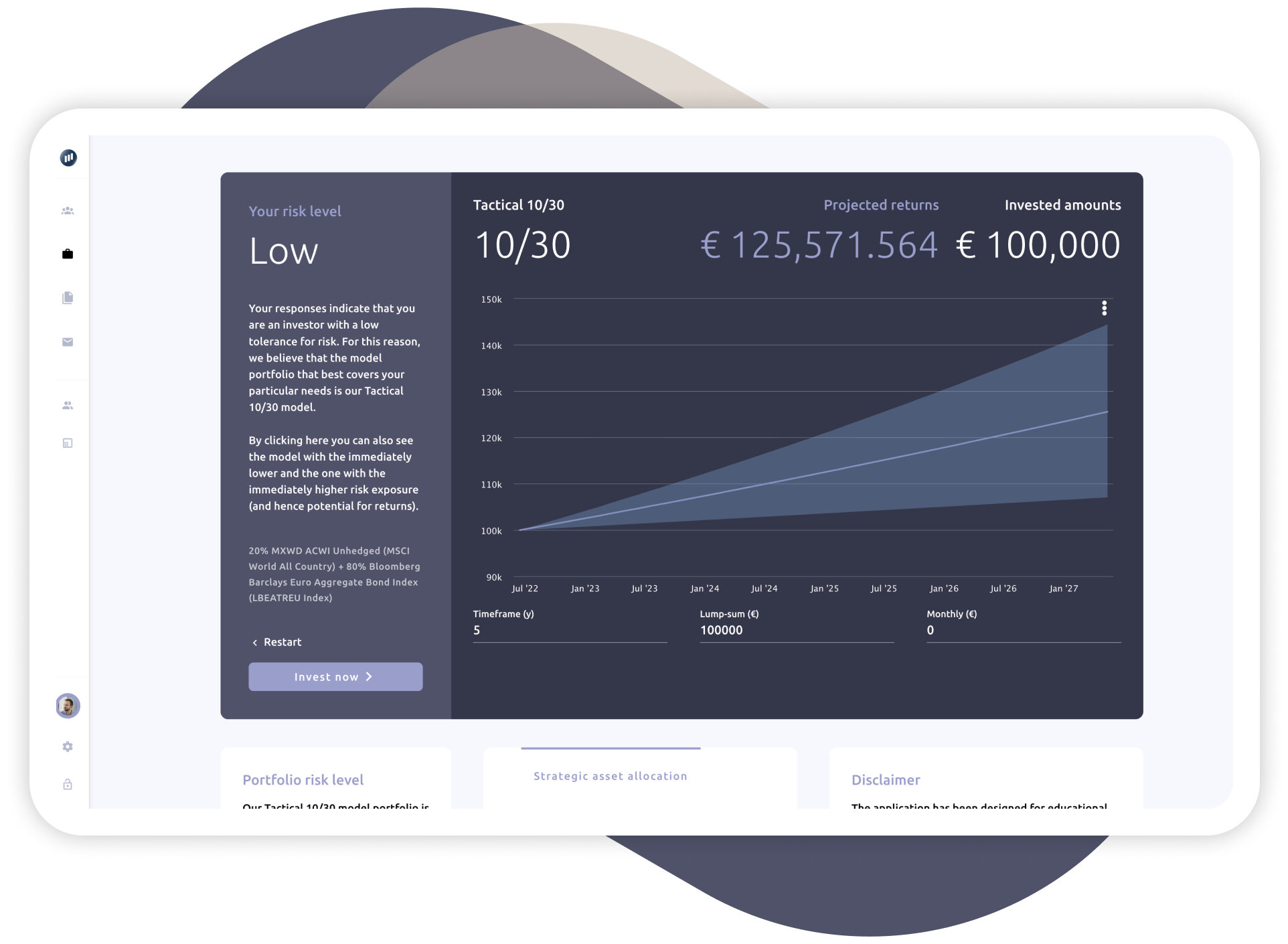

Instant portfolio access, with real-time valuations, lively charting and full transparency in terms of asset allocation, performance and fees.

Personalised experience

Ensure digital self-servicing across the customer lifecycle, using smart forms, e-signatures and KYC/AML checks.

Cloud-native platform as enabler of innovation and agility.

Solution

Faster reporting

With a Wealth Portal, reports reach investors 10 times faster than quarterly valuations, improving client satisfaction.

Automate customer service

Transparent account access and self-servicing significantly reduce support enquiries, driving up advisor efficiency.

Reach new investors

A rich, multilingual digital presence supports growth plans, giving Iolcus access to a wider, pan-European audience.

Project profile

Iolcus Investments is a privately-owned, independent Wealth Manager, based in Athens, Greece. The firm manages assets on behalf of individuals and institutions, and offers carefully structured management fees that fully align with clients’ interests.

Driven by customer feedback, the company commissioned Invessed to create a new Wealth Portal for web and mobile. The platform has allowed Iolcus to engage a new generation of investors more efficiently.

More at iolcus.gr