Context

Can we upgrade our Client’s Experience?

Technology moves at an ever-increasing pace, especially in Wealth Management. An outdated Client Portal based on static information is not just a hindrance but a real liability. No wonder modernising client experience is front-on-mind for many companies.

However, a true upgrade needs planning and a methodical approach. Costs need to be managed, and security considerations need to be factored in at every step. How can a scaling organisation like Bowmore upgrade its Client Portal and minimise risk?

Challenges

The devil in the detail

Data sourcing

Collecting data from Custodians is never without challenges. Managing diverse sources and formats requires experience and solid technical skills.

Custom development

All organisations are different, and the Client Portal must reflect that. The platform needs to be flexible enough to scale with the needs of the business.

Client onboarding

User adoption is key. An intuitive sign-up process and clearly sign-posted investment reporting will help clients onboard and engage with their accounts.

Our solution

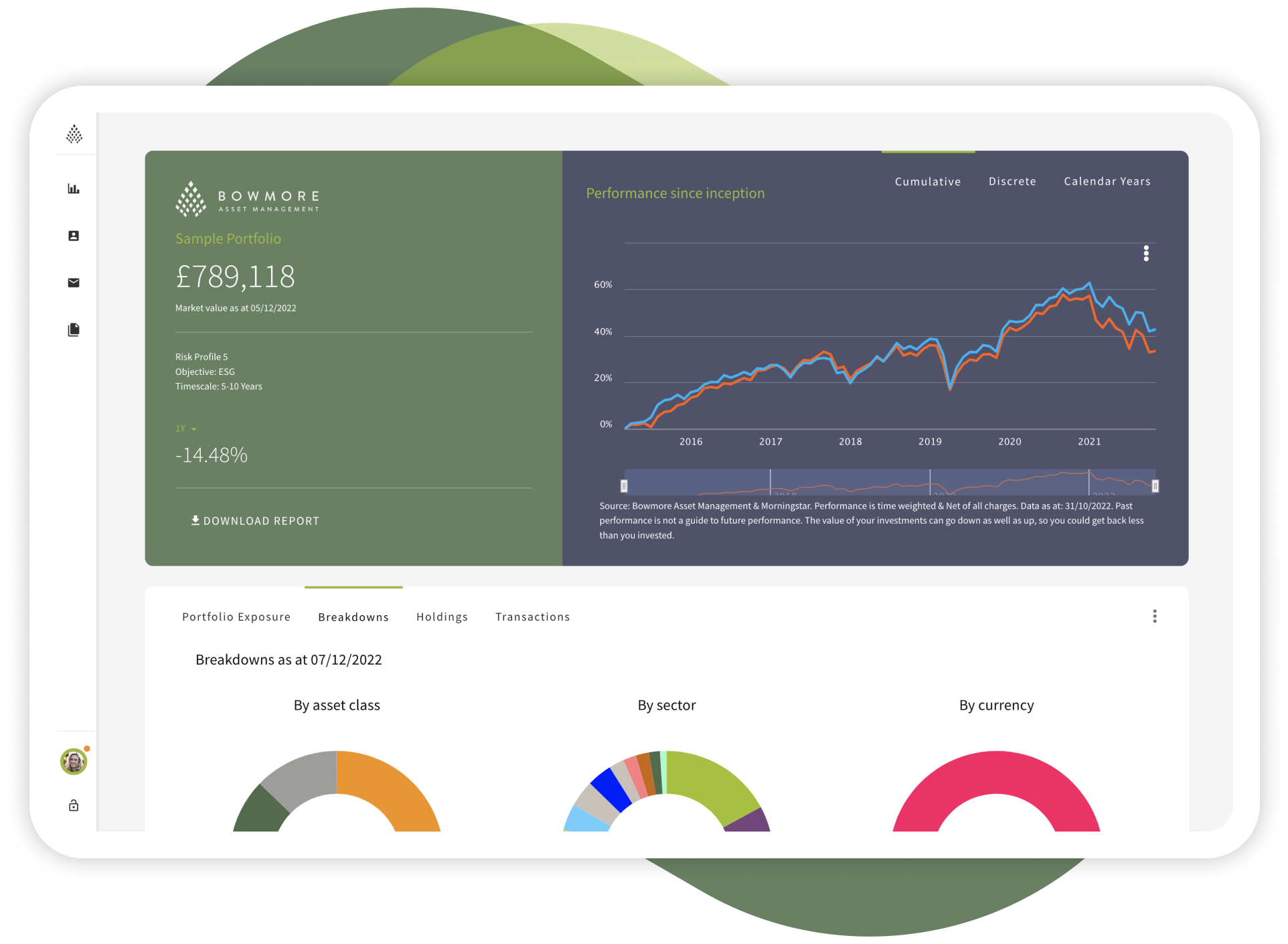

A Dynamic Client Experience

Data integration

Data is sourced from FIS Global using secure channels. Accuracy is verified against a bespoke ruleset before being loaded for immediate use on the Client Portal.

Multi-level access

The portal supports multiple levels of access including administration, advisors, account owners and beneficiaries, across consolidated and segregated accounts.

Dynamic reporting

Our reporting suite allows clients to explore valuations and performance at consolidated and account level, risk exposure, breakdowns, holdings and transactions.

Looking ahead

An ongoing evolution

Bowmore’s Client Portal provides a flexible and dynamic platform for future development. A number of new features and services are in development, supporting the company’s growth and ever-changing client demands.

More at bowmoream.com